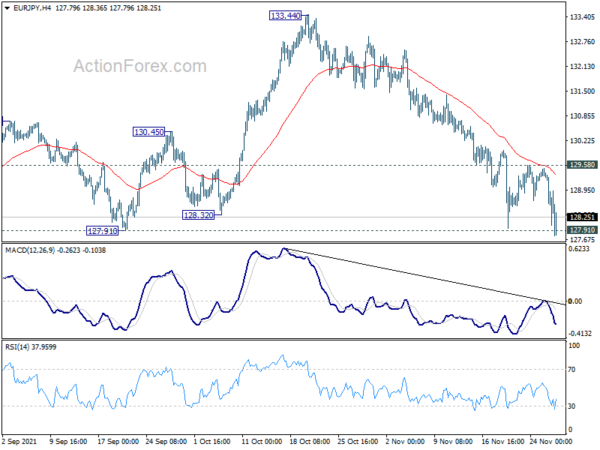

EUR/JPY’s fall from 133.44 resumed last week after some recovery. Initial bias is now on the downside this week with focus on 127.91 support. Firm break there will resume whole pattern from 134.11 and target 126.58 fibonacci level. Sustained break there will carry larger bearish implications. On the upside, however, break of 129.59 resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound first.

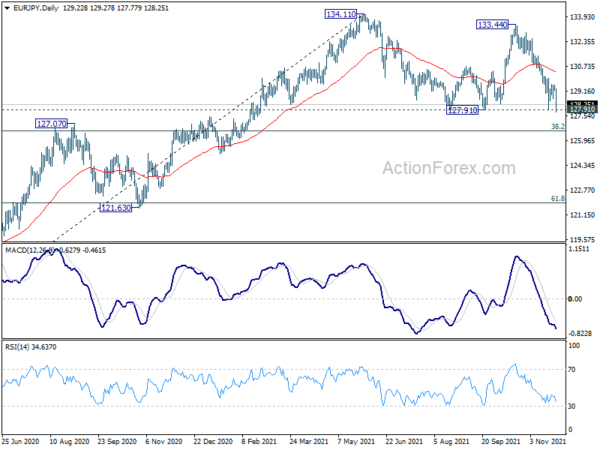

In the bigger picture, as long as 38.2% retracement of 114.42 (2020 low) to 134.11 at 126.58 holds, up trend from 114.42 is still in favor to continue. Break of 134.11 will target long term resistance at 137.49 (2018 high). However, sustained break of 126.58 will raise the chance of medium term bearish reversal. In this case, deeper decline would be seen to 61.8% retracement at 121.94, and possibly below.

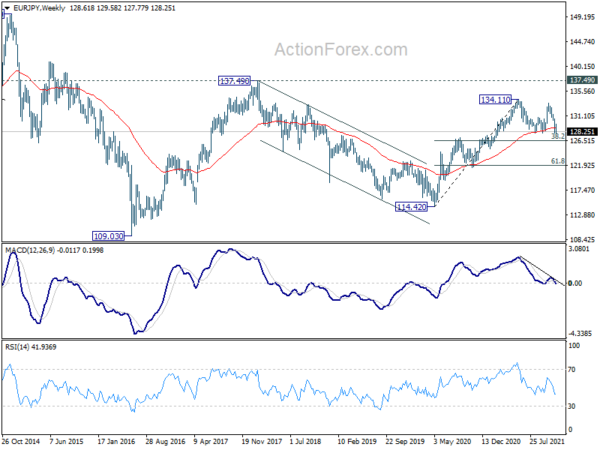

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Long term outlook will remain neutral until breakout from the range of 109.03/137.49.