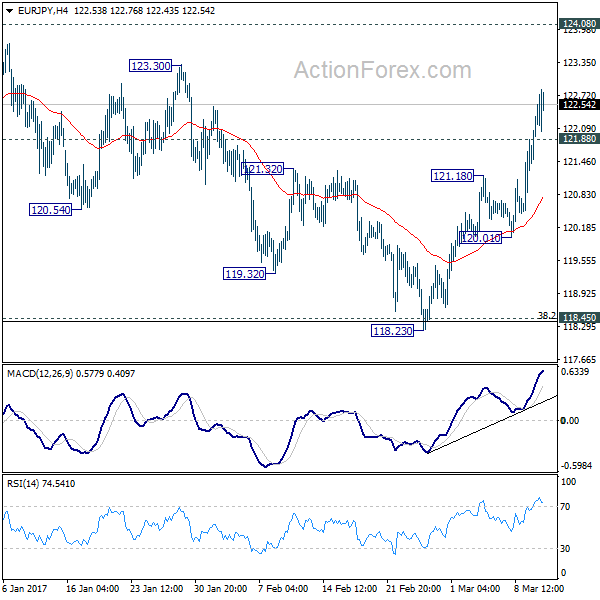

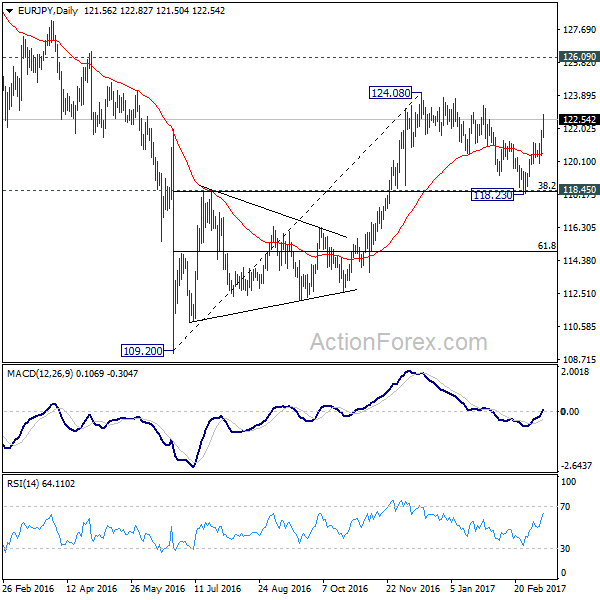

EUR/JPY’s rebound from 118.23 short term bottom continued last week and reached as high as 122.82. Outlook is unchanged that correction from 124.08 has completed at 118.23 after defending 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39). Rise from 109.20 is likely resuming.

Initial bias remains on the upside this week for 124.08 high. Break will resume whole medium term rally from 109.20 and target 126.09 key resistance next. On the downside, below 121.88 minor support will turn bias neutral and bring retreat before staging anther rally.

In the bigger picture, current development suggests that medium term rise from 109.20 is still in progress. Focus is now on 126.09 key resistance level. Sustained break will confirm completion of the whole decline from 149.76. And rise from 109.20 is of the same degree as the fall from 149.76. In such case, further rally would be seen to 104.04 resistance and possibly above before topping. Meanwhile, rejection from 126.09 will extend the fall from 149.76 through 109.209 low.

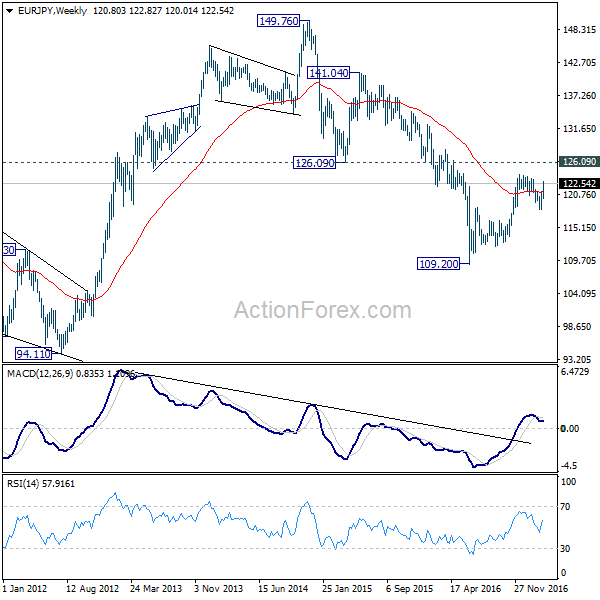

In the long term picture, medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. Decisive break of 126.09 will indicate that such decline is completed and EUR/JPY has started another medium term rally already. Before that, deeper fall is mildly in favor towards 94.11 low. Overall,, long term rang trading will continue.