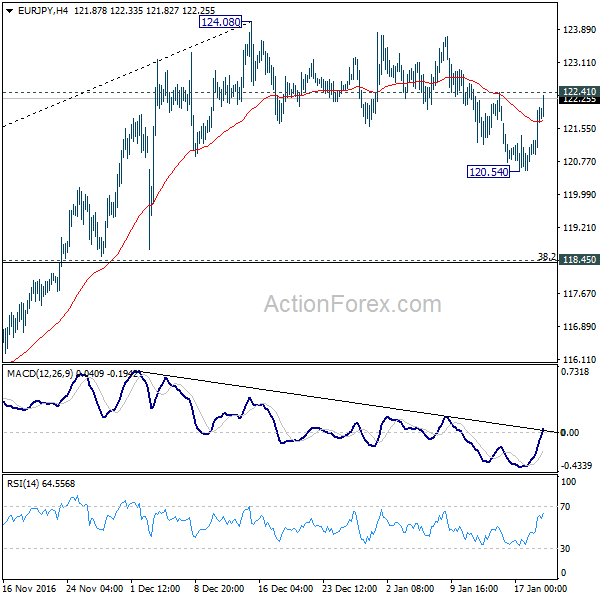

Daily Pivots: (S1) 120.95; (P) 121.46; (R1) 122.37; More…

A temporary low is in place at 120.54 in EUR/JPY after drawing support from 55 day EMA and intraday bias is turned neutral first. Break of 122.41 will argue that the correction from 124.08 has completed. More importantly, that will indicate that rebound from 109.20 is still in progress. In that case, intraday bias will be turned to the upside for 124.08 and then 126.09 key resistance. Below 120.54 will bring deeper fall to 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39).

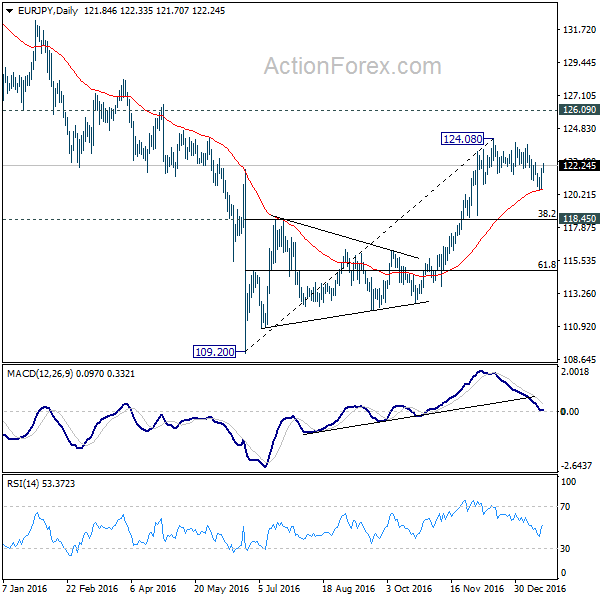

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we’d expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt. Sustained trading below 55 day EMA will pave the way to retest 109.20.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box