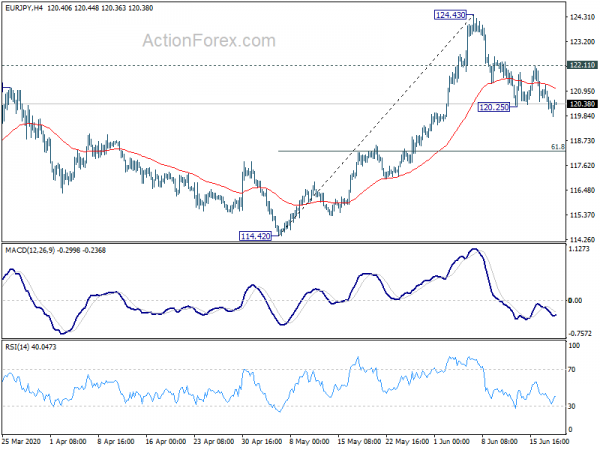

Daily Pivots: (S1) 119.89; (P) 120.57; (R1) 120.97; More…..

EUR/JPY’s break of 120.25 suggests resumption of decline from 124.43. Intraday bias is back on the downside. Deeper fall would be seen to 61.8% retracement of 114.42 to 124.43 at 118.24. On the upside, break of 122.11 resistance is needed to indicate completion of the decline. Otherwise, further fall will remain in favor in case of recovery.

In the bigger picture, whole down trend from 137.49 (2018 high) could have completed at 114.42 already. Rise from 114.42 would target 61.8% retracement of 137.49 to 114.42 at 128.67 next. Sustained break there will pave the way to 137.59 (2018 high). This will remain the preferred case for now, as long as 55 day EMA (now at 118.89) holds. However, sustained break of 55 day EMA will revive medium term bearishness for another low below 114.42 at a later stage.