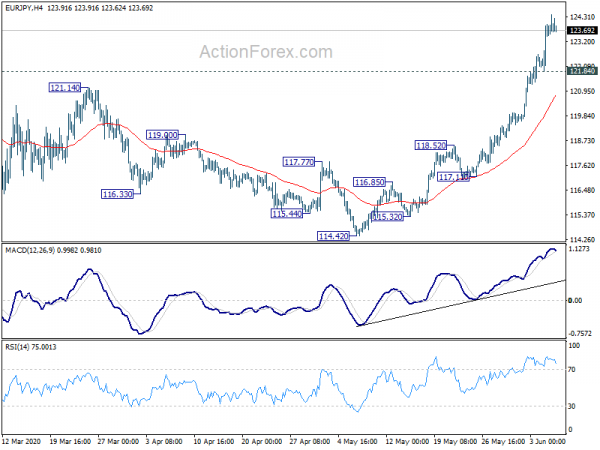

EUR/JPY’s rally accelerated to as high as 124.42 last week. Initial bias stays on the upside this week. Rise form 114.42 should target next fibonacci level at 128.67. On the downside, break of 121.84 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

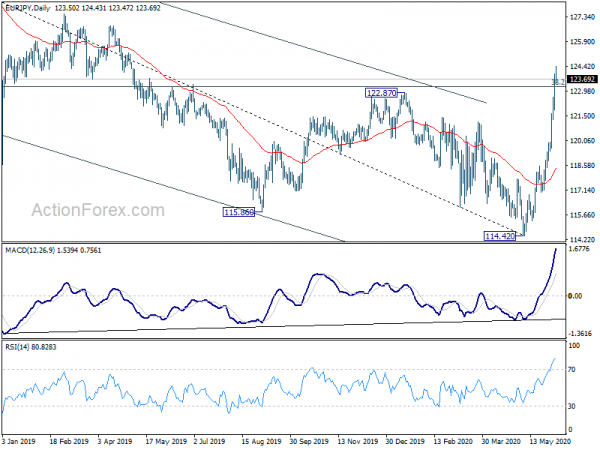

In the bigger picture, the firm break of 122.87 resistance suggests that whole down trend from 137.49 (2018 high) has completed at 114.42. Current rally should now target 61.8% retracement of 137.49 to 114.42 at 128.67 next. Sustained break there will pave the way to 137.59 (2018 high). This will remain the preferred case for now, as long as 55 day EMA (now at 118.45) holds.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Sustained break of 55 month EMA (now at 124.62) should confirm the start of another medium term rising leg. In this case, we’d tentatively look at 100% projection of 109.48 to 137.49 from 114.42 at 142.43 as the medium term target.