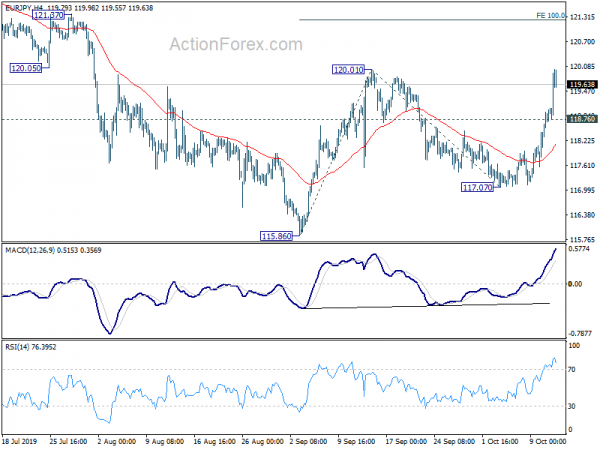

EUR/JPY’s strong rally last week suggests that rebound from 115.86 is ready to resume. The strong break of 55 day EMA and bullish convergence condition in daily MACD argues that 115.86 is a medium term bottom too. Initial bias stays on the upside this week. Break of 120.01 will target 100% projection of 115.86 to 120.01 from 117.07 at 121.16 first. On the downside, though, below 118.76 will mix up the outlook and turn intraday bias neutral first.

In the bigger picture, current development argues that a medium term bottom is formed at 115.86, on bullish convergence condition in daily MACD, ahead of 114.84 support. Break of 120.78 support turned resistance will affirm this case and bring further rise to falling channel resistance (now at 126.10). Reactions from there would decide whether the medium term has reversed. For now, further rise is expected as long as 117.07 support holds.

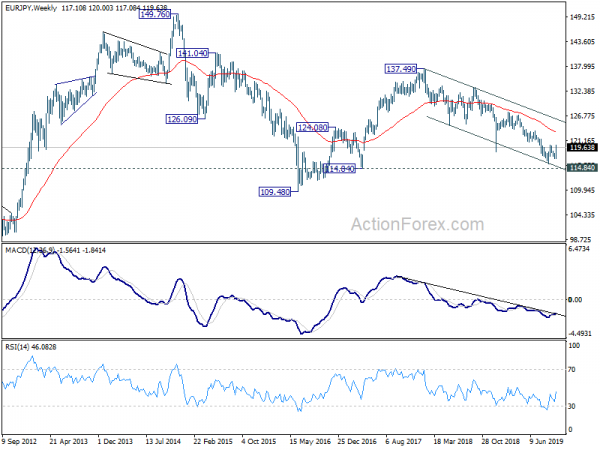

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. This falling leg would target 109.48 (2016 low). With EUR/JPY staying below 55 month EMA, this is the preferred case.