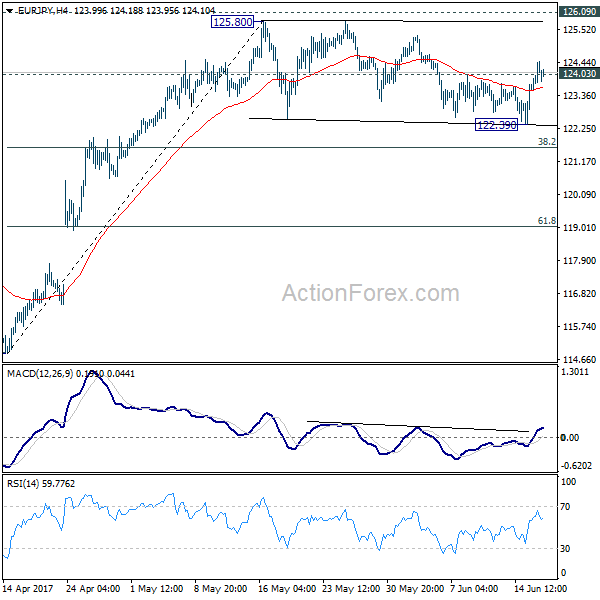

EUR/JPY dipped to 122.39 but drew support from 55 day EMA and rebounded. Initial bias stays mildly on the upside this week for 125.80/126.09 resistance zone. Decisive break of 126.09 will extend the whole rebound from 109.03 to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. In case of another fall as consolidation from 125.80 extends, we’d still expect strong support from 38.2% retracement of 114.84 to 125.80 at 121.61 to bring rebound and then rise resumption.

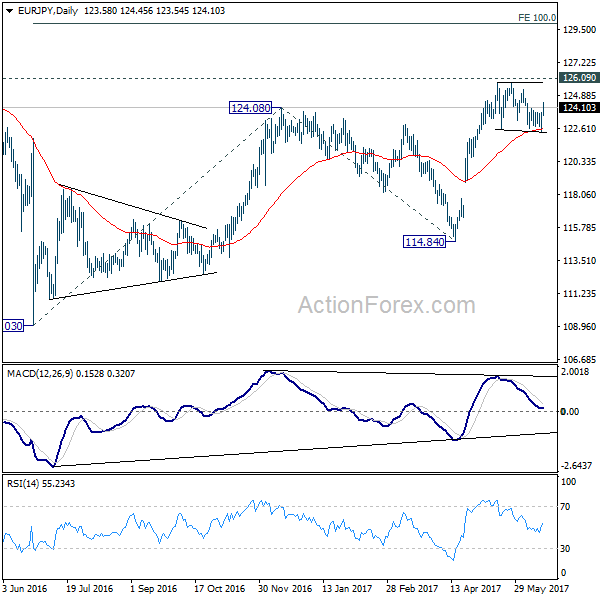

In the bigger picture, focus is staying on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.

In the long term picture, medium term decline from 149.76 is seen as part of a long term sideway pattern from 88.96. We’re not seeing any sign of an established long term trend yet. Hence, we’ll be cautious on strong support at 94.11 in case of another fall. Also, there could be strong resistance at 149.76 in case of a medium term rise.