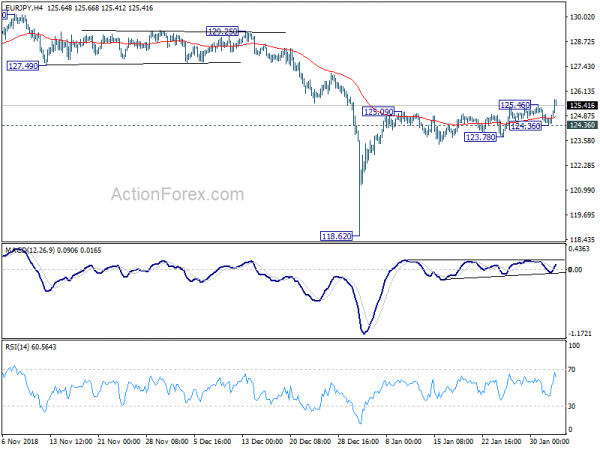

EUR/JPY’s rebound from 118.62 extended last week even though upside momentum has been unconvincing. Further rise is expected this week for 55 days EMA (now at 126.15). We’d be cautious on strong resistance from there to limit upside. And, break of 124.36 support will argue that the rebound has completed and turn bias to the downside. Nevertheless, sustained trading above 55 day EMA will pave the way back to 129.25 resistance next.

In the bigger picture, medium term rebound from 109.03 (2016 low) has completed at 137.49 already, with corrective structure. Fall from 137.39 is possibly just the second leg of the corrective pattern from 109.03. Break of 133.12 resistance should start the third leg to 137.49 and above. Nevertheless, break of 118.62 will resume the decline from 137.49 for 109.03/114.84 support zone instead.

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Fall from 137.49 is seen as a falling leg inside the pattern. It could extend through 109.03 to resume the decline from 149.76 But in that case, we’d expect strong support around 94.11 (2012 low) to bring reversal.