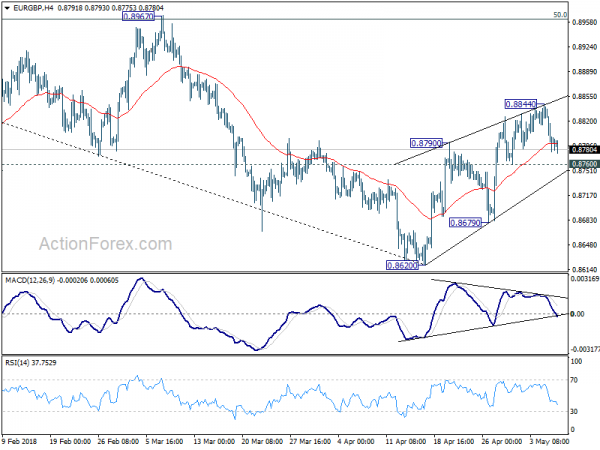

Daily Pivots: (S1) 0.8769; (P) 0.8803; (R1) 0.8828; More…

Intraday bias in EUR/GBP remains neutral for the moment. Loss of momentum as seen in 4 hour MACD and the steep retreat from 0.8844 argues that rebound from 0.8620 might be completed. Break of 0.8760 minor support will turn bias to the downside for 0.8679. Break there will likely resume whole decline from 0.9305 through 0.8620 low. On the upside, above 0.8844 will revive near term bullishness for 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963).

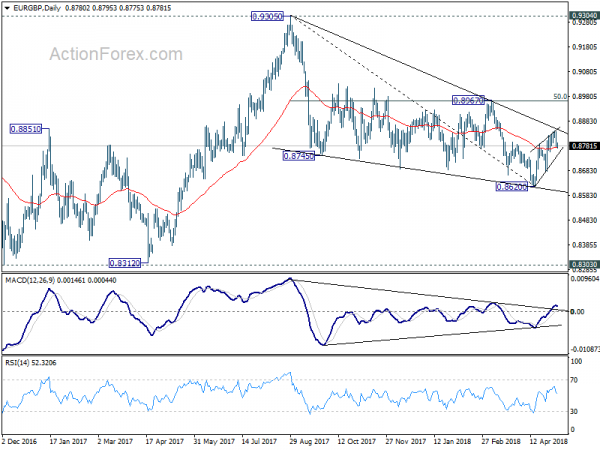

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.