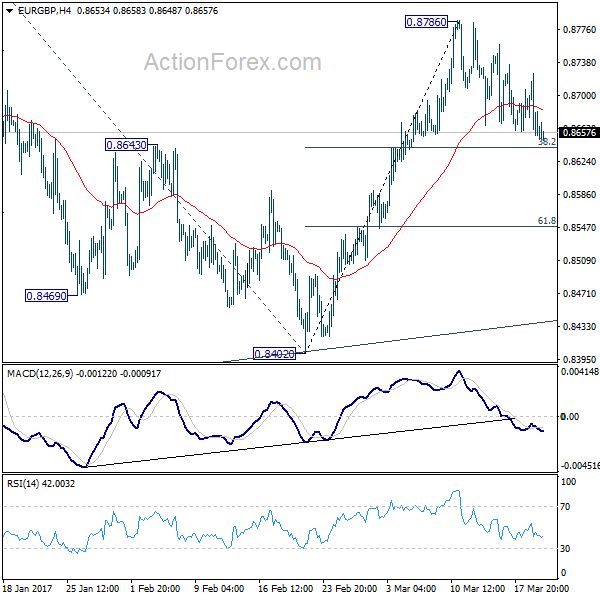

Daily Pivots: (S1) 0.8631; (P) 0.8679; (R1) 0.8708; More…

EUR/GBP’s correction from 0.8786 is still in progress and intraday bias remains neutral. In case of another fall, we’d expect support from 38.2% retracement of 0.8402 to 0.8786 at 0.8639 to contain downside. Break of 0.8786 will target 0.8851 resistance and above. Price actions from 0.8303 are seen as the second leg of the corrective pattern from 0.9304. Hence, we’d expect strong resistance from 100% projection of 0.8303 to 0.8851 from 0.8402 at 0.8950 to limit upside. On the downside, sustained trading below 0.8693 will bring deeper fall to 61.8% retracement 0.8549 and below.

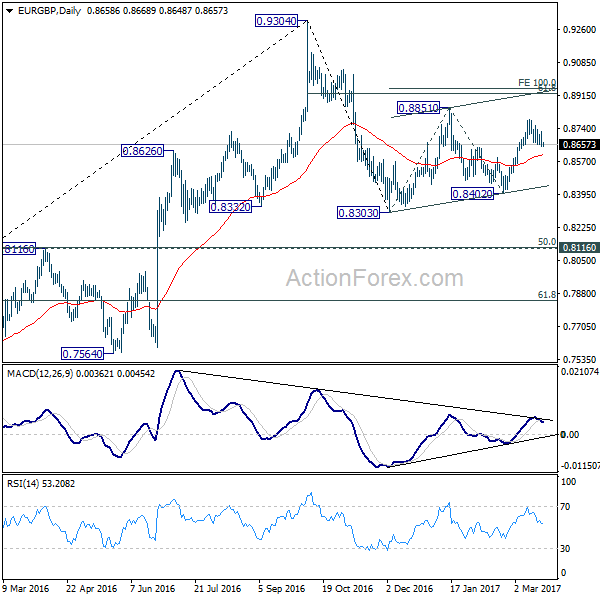

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).