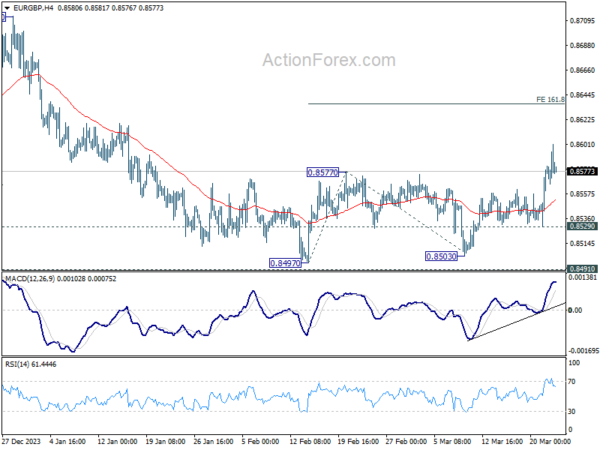

EUR/GBP’s break of 0.8577 resistance and 55 D EMA (now at 0.8562) last week suggest that rebound from 0.8497 is at least correcting the fall from 0.8764. Initial bias is now on the upside this week for 161.8% projection of 0.8497 to 0.8577 from 0.8503 at 0.8632. For, further rise will remain in favor as long as 0.8529 minor support holds, in case of retreat.

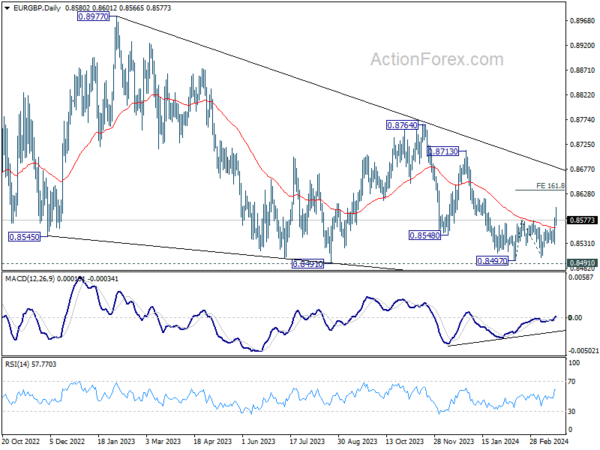

In the bigger picture, there is no clear sign that down trend from 0.9267 has completed, despite loss of downside momentum as seen in D MACD. As long as 0.8713 resistance holds, the down trend will remain in favor to resume through 0.8491 low at la later stage.

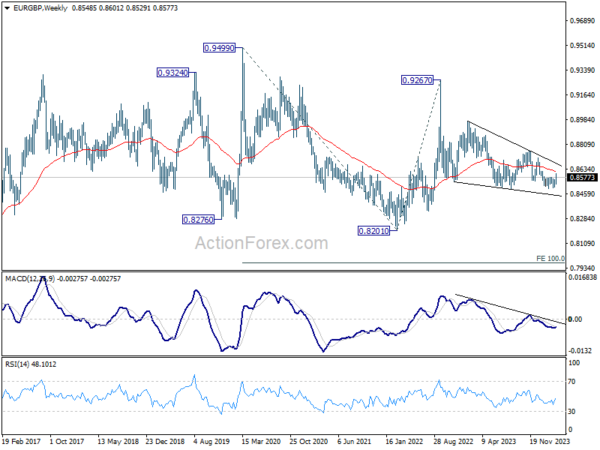

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Fall from 0.9267 is the third leg of the pattern from 0.9499. Break of 0.8201 (2022 low) will target 100% projection of 0.9499 to 0.8201 from 0.9267 at 0.7969.