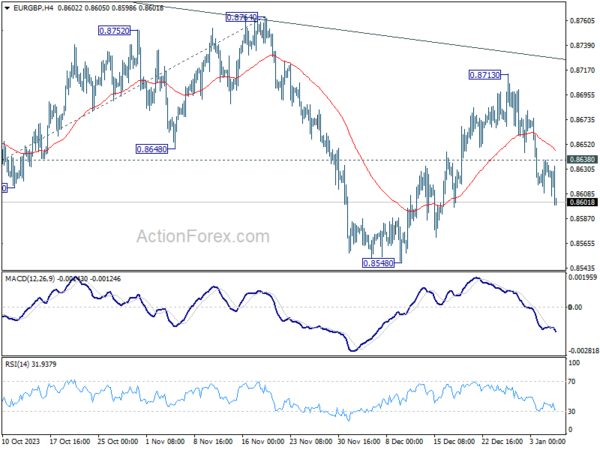

EUR/GBP’s decline last week suggests that rebound from 0.8548 has completed at 0.8713 already. Initial bias stays mildly on the downside this week for 0.8548 support first. Firm break there will target 0.8491 low next. On the upside, above 0.8638 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 0.8713 resistance holds, in case of recovery.

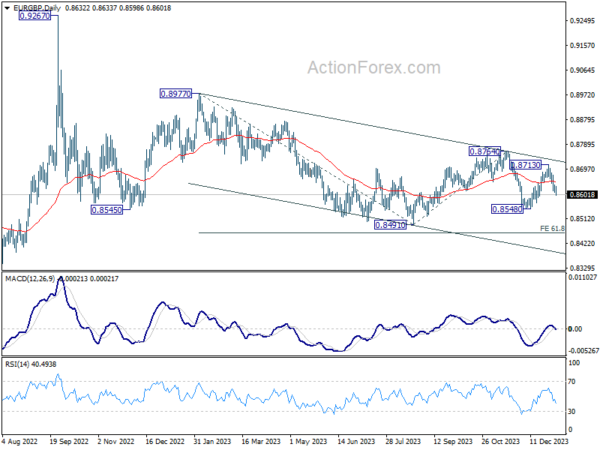

In the bigger picture, fall from 0.8764 is seen as another leg in the whole down trend from 0.9267 (2022 high). Outlook will stay bearish as long as 0.8764 resistance holds. Break of 0.8491 will target 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464.

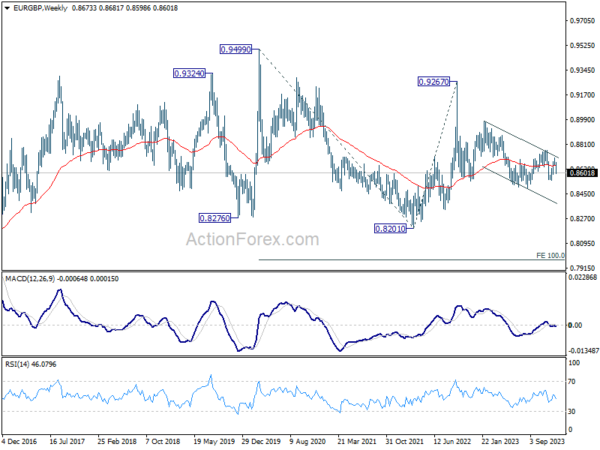

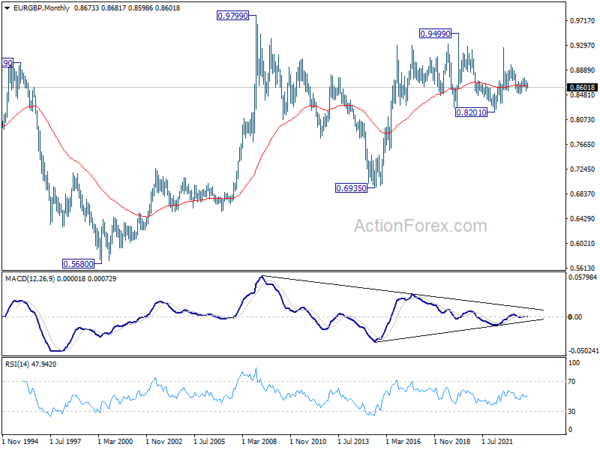

In the long term picture, price action from 0.9499 (2020 high) is see as part of the long term range pattern from 0.9799 (2008 high). Fall from 0.9267 is the third leg of the pattern from 0.9499. Break of 0.8201 (2022 low) will target 100% projection of 0.9499 to 0.8201 from 0.9267 at 0.7969.