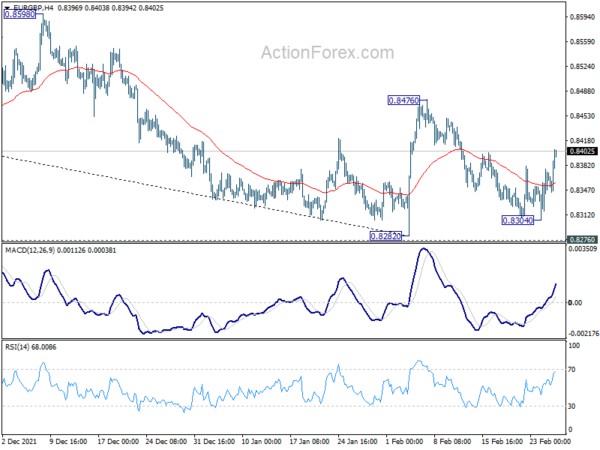

EUR/GBP’s pull back from 0.8476 could have completed at 0.8304 last week. Initial bias is now mildly on the upside for 0.8476 resistance first. Break there will resume the rebound from 0.8282 to 0.8598 key resistance level. On the downside, though, break of 0.8304 will turn bias back to the downside for 0.8282 low again.

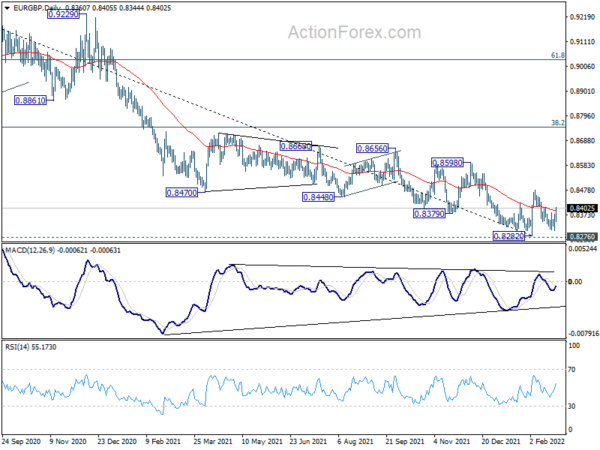

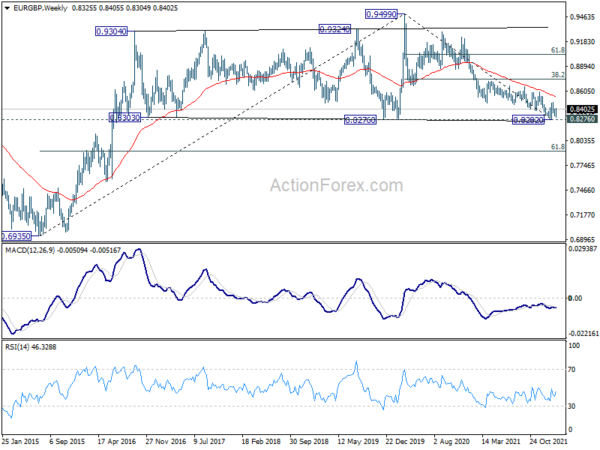

In the bigger picture, price actions from 0.9499 (2020 high) are still seen a corrective pattern that should be contained by 0.8276 long term support (2019 low). Sustained trading above 38.2% retracement of 0.9499 to 0.8282 at 0.8747 will affirm this bullish case. However, sustained break of 0.8276 will argue that the long term trend has reversed. Deeper decline would be seen to 61.8% retracement of 0.6935 to 0.9499 at 0.7917.

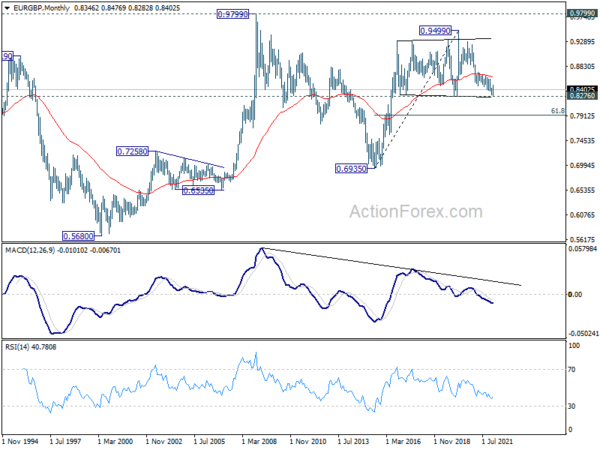

In the long term picture, outlook will stay bullish as long as 0.8276 support holds. Break of 0.9499 is in favor at a later stage, to resume the up trend from 0.6935 (2015 low). However, sustained break of 0.8276 will indicate long term trend reversal, and target 61.8% retracement of 0.6935 to 0.9499 at 0.7917, and possibly below.