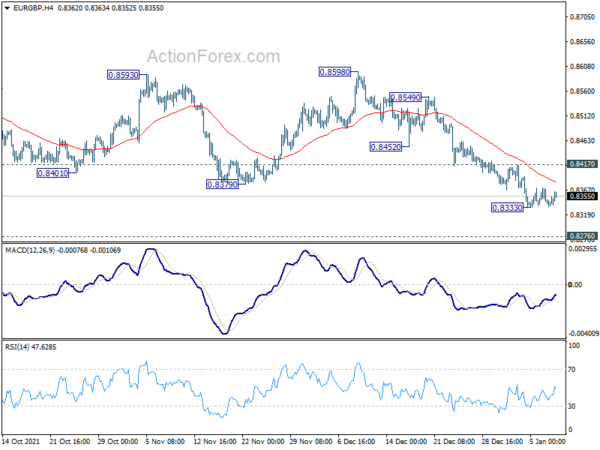

EUR/GBP dropped further to 0.8333 last week but turned sideway since then. Initial bias is neutral this week first for some consolidations. Outlook stays bearish as long as 0.8417 resistance holds. Break of 0.8333 will resume larger down trend for 0.8276 key long term support. On the upside, above 0.8417 minor resistance will turn bias back to the upside for stronger rebound.

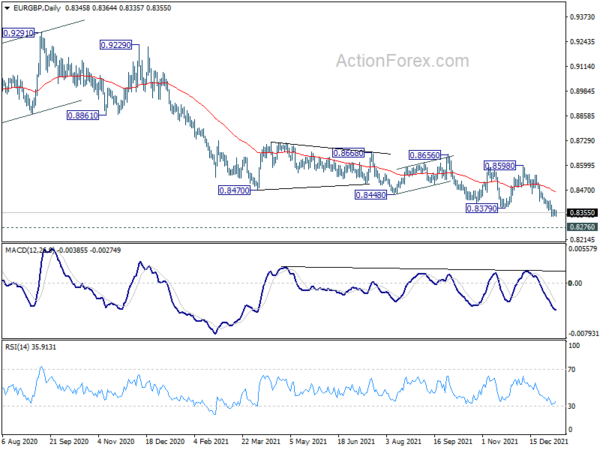

In the bigger picture, price actions from 0.9499 (2020 high) are still seen as developing into a corrective pattern. Deeper fall could be seen as long as 0.8598 resistance holds, towards long term support at 0.8276. We’d look for bottoming signal around there to bring reversal. Meanwhile, firm break of 0.8598 will now be an early sign of medium term bottoming and bring stronger rebound. However, sustained break of 0.8276 will argue that the long term trend has reversed.

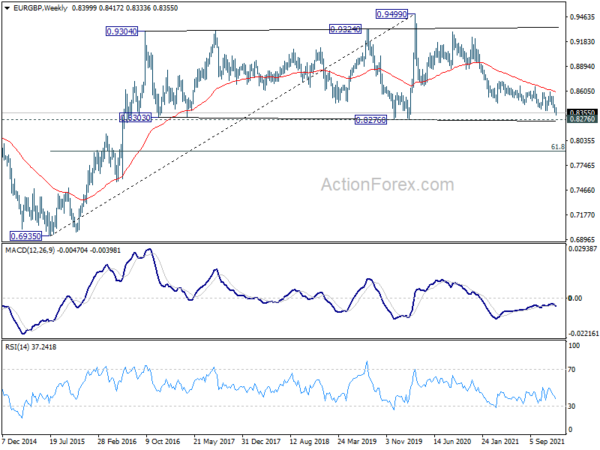

In the long term picture, outlook will stay bullish as long as 0.8276 support holds. Break of 0.9499 is in favor at a later stage, to resume the up trend from 0.6935 (2015 low). However, sustained break of 0.8276 will indicate long term trend reversal, and target 61.8% retracement of 0.6935 to 0.9499 at 0.7917, and possibly below.