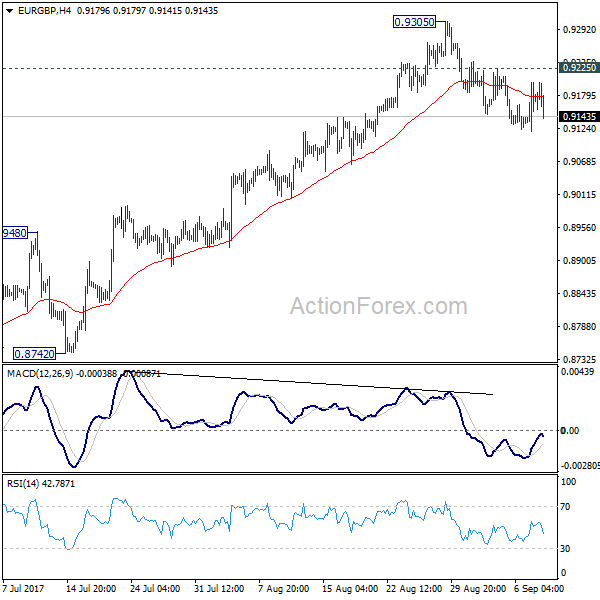

Daily Pivots: (S1) 0.9118; (P) 0.9141; (R1) 0.9159; More

No change in EUR/GBP’s outlook. With 0.9225 minor resistance intact, deeper fall is expected to target 55 day EMA (now at 0.9019). Sustained trading below there will likely start the third leg of the consolidation from 0.9304 and target 0.8303 key support again. On the upside, above 0.9236 minor resistance will turn bias back to the upside for 0.9225 minor resistance instead.

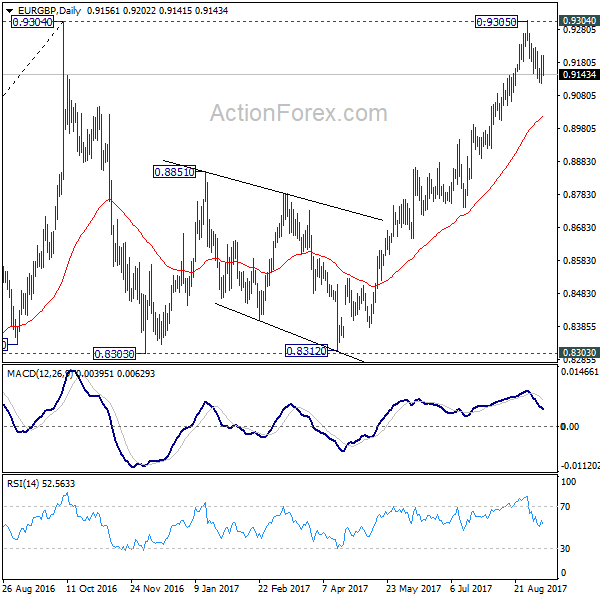

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes. Firm break of 0.9799 high will target 61.8% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.