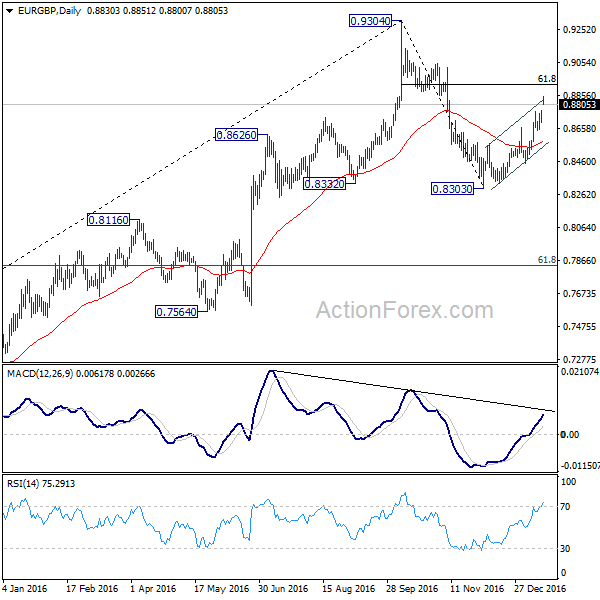

Daily Pivots: (S1) 0.8686; (P) 0.8726; (R1) 0.8760; More…

EUR/GBP’s rebound form 0.8303 extends today and intraday bias stays on the upside for 61.8% retracement of 0.9304 to 0.8303 at 0.8922 and above. Such rebound is seen as the second leg of the consolidation pattern from 0.9304. Hence, we’ll be cautious on topping above 0.8922. On the downside, though, break of 0.8646 minor support is needed to indicate completion of the rise. Otherwise, near term outlook will stay cautiously bullish in case of retreat.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support around 55 weeks EMA (now at 0.8260) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box