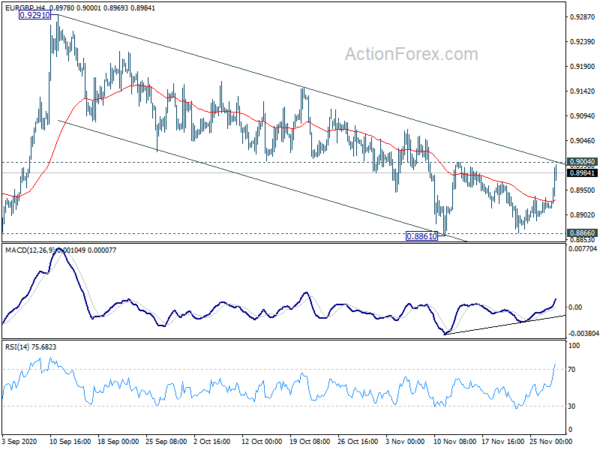

EUR/GBP was supported by 0.8866 structural support again last week and rebounded. Though, upside is limited below 0.9004 resistance so far. Initial bias stays neutral this week first. On the upside, firm break of 0.9004 and the falling channel resistance will firstly indicate short term bottoming. Secondly, pull back from 0.9291 should have completed. Thirdly, with 0.8866 support intact, rise from 0.8276 isn’t over. Intraday bias will be turned back to the upside for 0.9291 resistance in this case. On the downside, however, sustained break of 0.8866 will extend the pattern from 0.9499 with another falling leg to 0.8670 and possibly below.

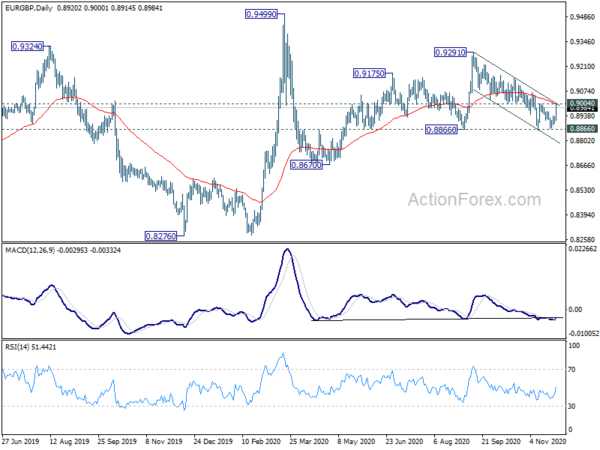

In the bigger picture, at this point, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. Decisive break of 0.9499 will target 0.9799 (2008 high).

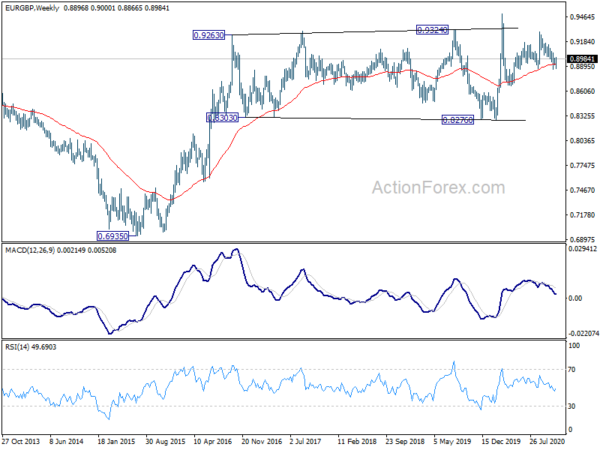

In the long term picture, rise from 0.6935 (2015 low) is still in progress. It could be resuming long term up trend from 0.5680 (2000 low). Break of 0.9799 (2008 high) is expected down the road, as long as 0.8276 support holds.