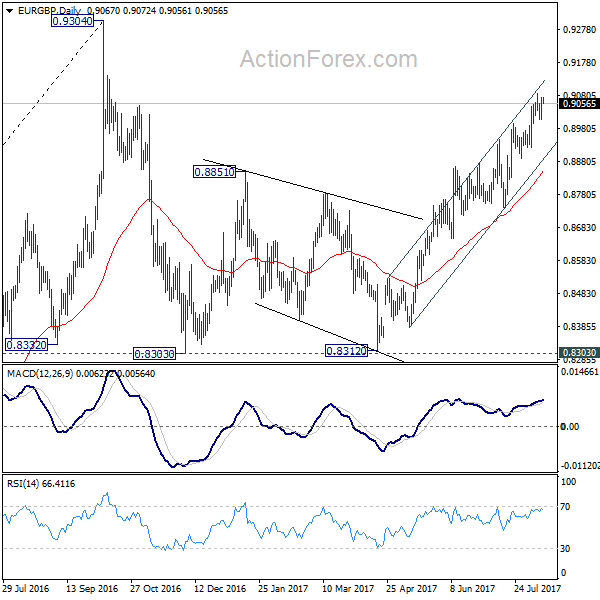

Daily Pivots: (S1) 0.9027; (P) 0.9051; (R1) 0.9095; More

Intraday bias in EUR/GBP remains neutral for consolidation below 0.9087 temporary top. While another retreat cannot be ruled out, further is still expected as long as 0.8890 support holds. Above 0.9087 will extend the rebound from 0.8312 to 0.9304 key high. At this point, there is no clear sign of up trend resumption yet. Hence, we’ll be cautious on strong resistance from 0.9304 to limit upside and bring another fall. On the downside, break of 0.8890 will be the first indication of near term reversal. In such case, intraday bias will be turned back to the downside for 0.8742 support for confirmation.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.