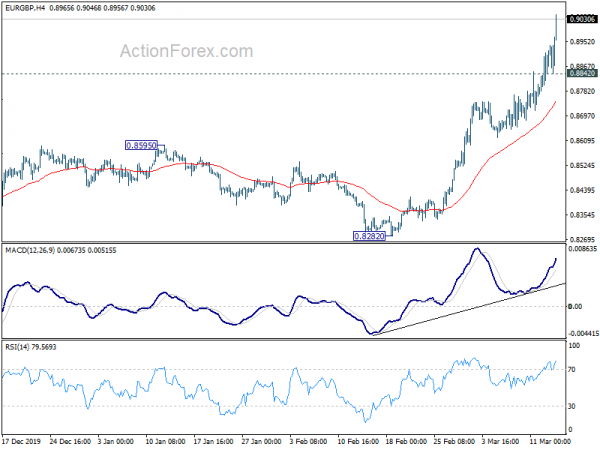

EUR/GBP surged to as high as 0.9048 last week. The development indicates that whole decline from 0.9324 has completed at 0.8276 already. Initial bias stays on the upside this week for retesting 0.9324 high. On the downside, break of 0.8842 minor support will turn intraday bias neutral to bring consolidations first.

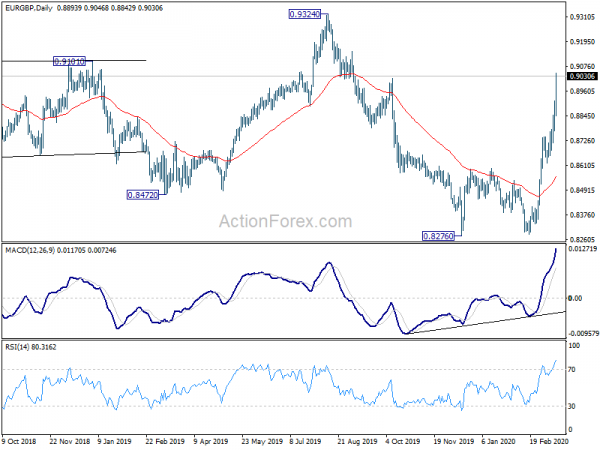

In the bigger picture, there are various interpretations in medium term price actions from 0.9263 (2016 high). We’re currently favoring the case that it’s a consolidation pattern with fall from 0.9324 to 0.8276 as the third leg, due to the strong impulsive rally from 0.8276. Decisive break of 0.9324 will confirm resumption of whole up trend from 0.6935, for 0.9799 (2008 high). This will remain the favored case as long as 0.8276 support holds.

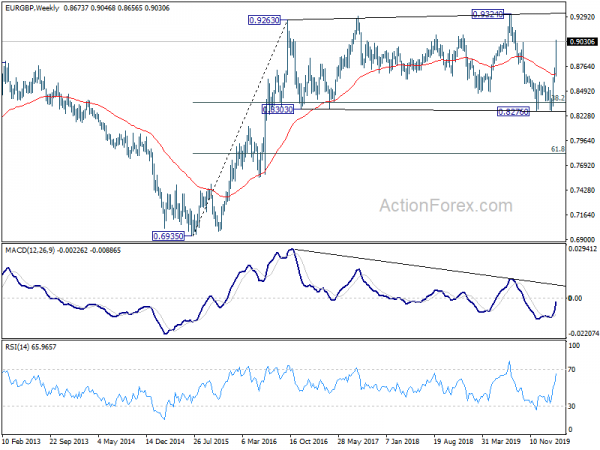

In the long term picture, current development suggests that up trend form 0.6935 is still in progress. It would be the third leg of the whole up trend from 0.5680 (2000 low). Decisive break of 0.9263 should indicate resumption of such long term up trend.