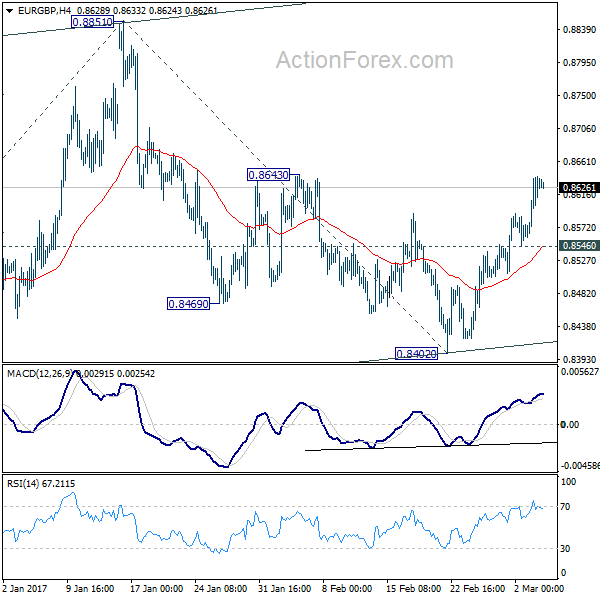

Daily Pivots: (S1) 0.8583; (P) 0.8611; (R1) 0.8665; More…

Intraday bias in EUR/GBP remains on the upside for the moment. Current development argues that pull back from 0.8851 is finished at 0.8402 already. Rise from there is possibly the third leg of the corrective price actions from 0.8303. Further rise would now be seen to 0.8851 and possibly above. Nonetheless, whole price actions fro 0.8303 are viewed as the second leg of the correction from 0.9304. Hence, we’d expect strong resistance from 100% projection of 0.8303 to 0.8851 from 0.8402 at 0.8950 to limit upside. On the downside, below 0.8546 minor support will turn bias back to the downside for 0.8402 support.

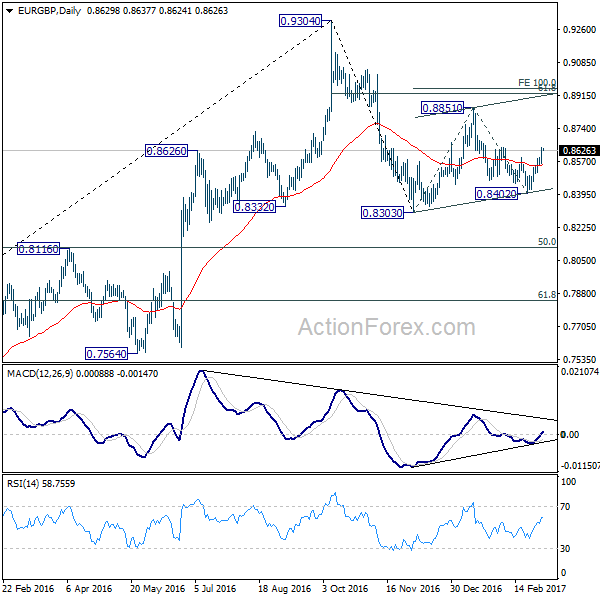

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).