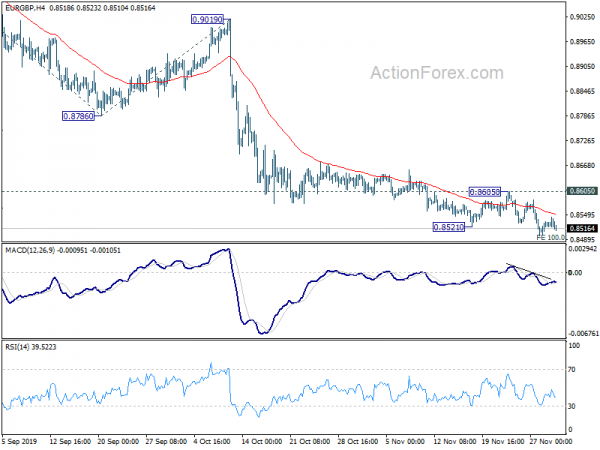

EU/GBP’s decline resumed last week by breaking 0.8521 temporary low. Initial bias remains on the downside this week. Current fall from 0.9324 should target 100% projection of 0.9324 to 0.8786 from 0.9019 at 0.8481, which is close to 0.8472 key support. We’d look for strong support from there to contain downside to bring rebound. On the upside, break of 0.8605 resistance will indicate short term bottoming and bring stronger rebound back to 0.8786 support turned resistance.

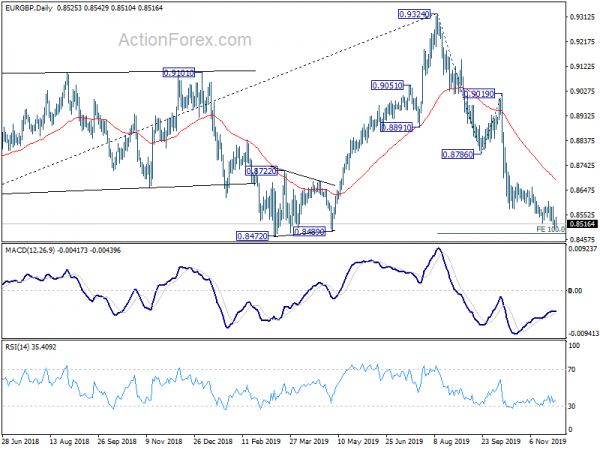

In the bigger picture, correction from 0.9324 medium term top is still in progress. Deeper fall should be seen back to 38.2% retracement of 0.6935 to 0.9324 at 0.8411 but strong support should be seen there, at least on first attempt, to bring rebound. On the upside, break of 0.9324 is needed to confirm up trend resumption. Otherwise, risk will stay on the downside even in case of strong rebound. Meanwhile, sustained break of 0.8411 will pave the way to 0.7848.

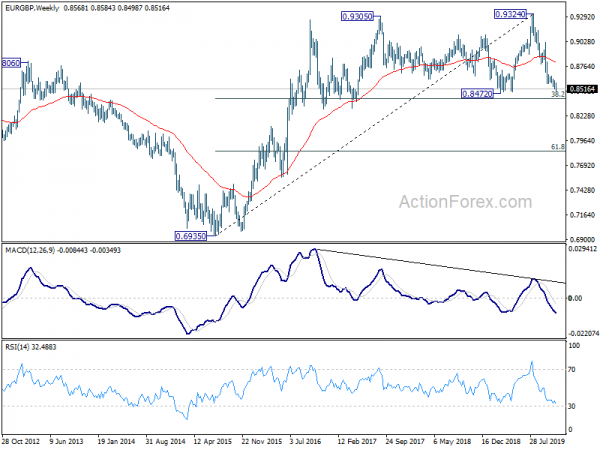

In the long term picture, rise from 0.6935 (2015 low) could either be resuming the up trend from 0.5680 (2000 low). Or it’s just the second leg of the consolidation pattern from 0.9799 (2008 high). Eventual structure of the pull back from 0.9324 should reveal which case it should be.