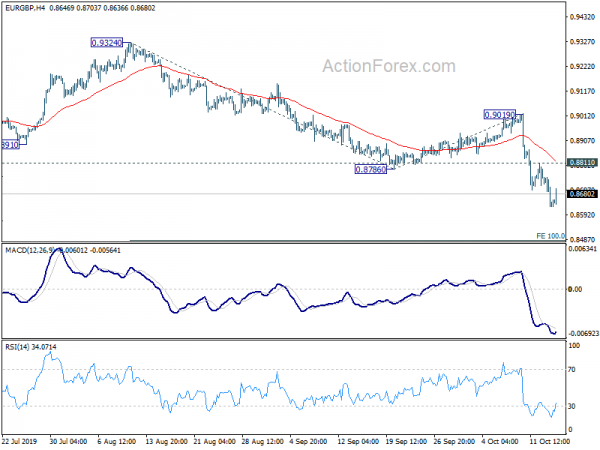

Daily Pivots: (S1) 0.8587; (P) 0.8669; (R1) 0.8712; More…

Intraday bias in EUR/GBP remains on the downside with 0.8811 minor resistance intact. Current fall from 0.9324 is still in progress and would target 100% projection of 0.9324 to 0.8786 from 0.9019 at 0.8481. However, break of 0.8811 will turn intraday bias neutral and bring more consolidations. But recovery should be limited below 0.9019 resistance to bring another decline.

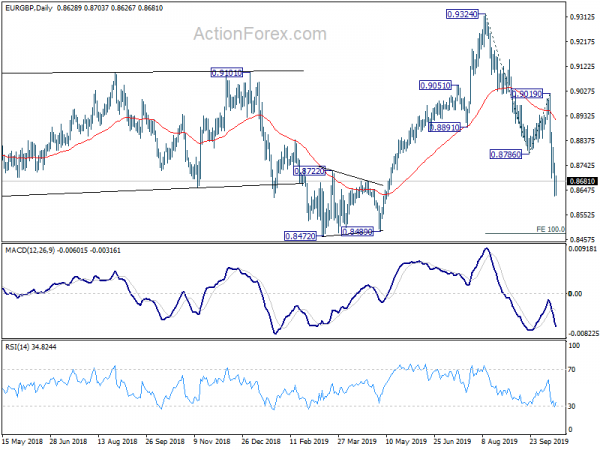

In the bigger picture, we’re now seeing 0.9324 as a medium term top on bearish divergence condition in weekly MACD. Price actions from there should develop into a corrective pattern. Deeper fall should be seen back to 38.2% retracement of 0.6935 to 0.9324 at 0.8411 but strong support should be seen there, at least on first attempt. On the upside, break of 0.9324 is needed to confirm up trend resumption. Otherwise, risk will stay on the downside even in case of strong rebound.