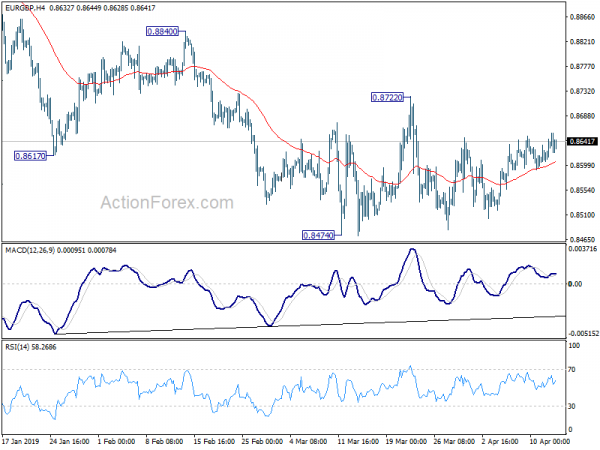

EUR/GBP stayed in consolidation in range of 0.8474/8722 last week and outlook remains unchanged. Initial bias remains neutral this week and more sideway trading could be seen. With 0.8722 resistance intact, larger decline is expected to resume sooner or later. On the downside, firm break of 0.8474 will resume larger down trend for 0.8416 long term projection next. On the upside, though, sustained break of 0.8722 will suggest near term reversal and bring stronger rise back to 0.8840 resistance and above.

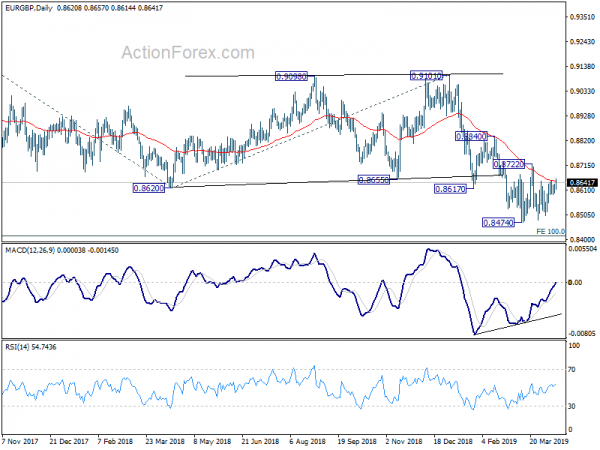

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Current fall from 0.9305 (2017 high) is a falling leg inside the pattern. Such decline could extend to 100% projection of 0.9305 to 0.8620 from 0.9101 at 0.8416 and possibly below. But for now, we’d expect strong support around 0.8312 support to contain downside and bring rebound.

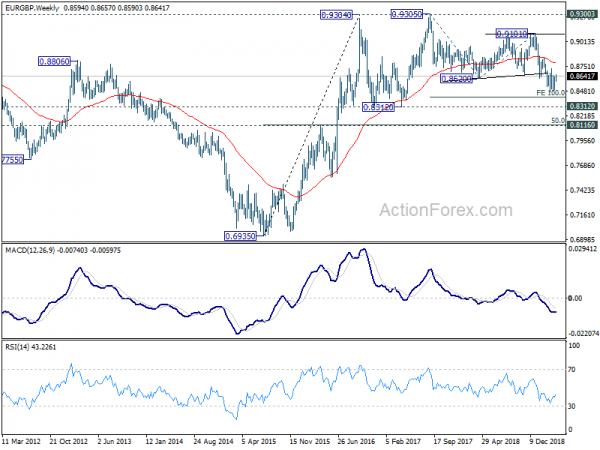

In the long term picture, we’re holding on to the view that rise from 0.6935 (2015 low) is resuming the up trend from 0.5680 (2000 low). As long as 50% retracement of 0.6935 to 0.9304 at 0.8120 holds, further rise should be seen through 0.9305 to 0.9799 and above down the road.