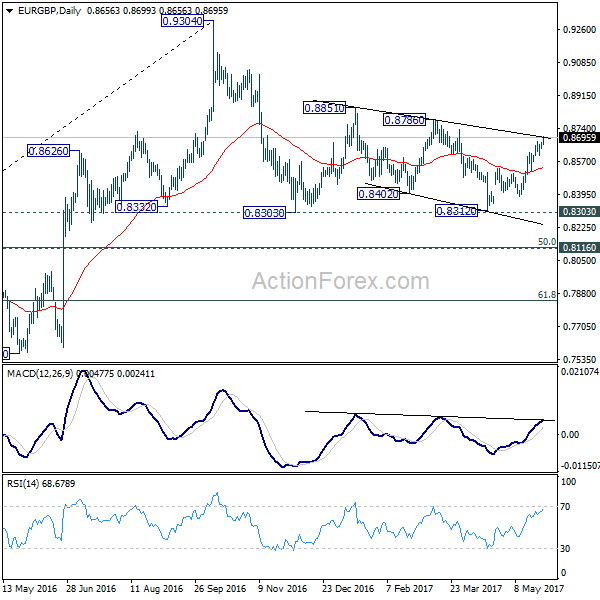

Daily Pivots: (S1) 0.8642; (P) 0.8655; (R1) 0.8673; More…

A temporary top is in place at 0.8750 and intraday bias in EUR/GBP is turned neutral for consolidations. Near term outlook stays mildly bullish as long as 0.8602 support holds and further rally would be seen. Above 0.8750 will target 0.8786 resistance first. Break of 0.8786 would pave the wave for retesting 0.9304 high. Break of 0.8602, however, will argue that the rebound from 0.9312 has completed and turn bias back to the downside for 0.8529 first.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. The leg from 0.9304 should have completed after taking 0.8332 structural support. But it’s too early to say that larger rise from 0.6935 is resuming. Rejection from 0.9304 will extend the consolidation with another falling leg. Meanwhile, firm break of 0.9304 will target 0.9799 (2008 high). In case of another decline, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound.