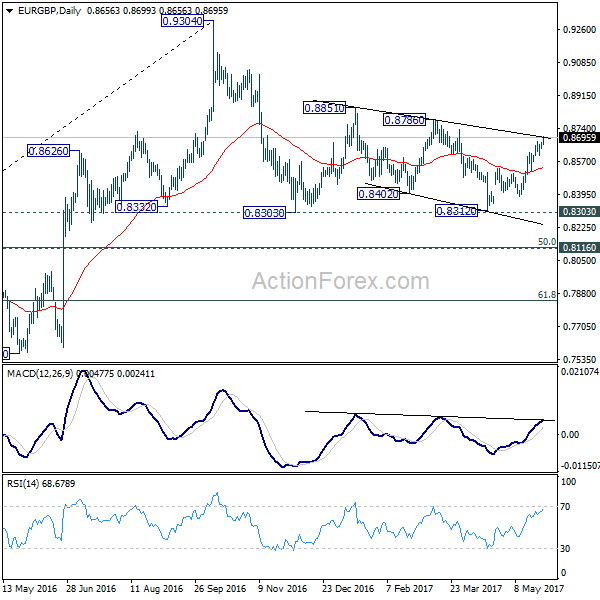

Daily Pivots: (S1) 0.8642; (P) 0.8655; (R1) 0.8673; More…

EUR/GBP’s rally resumed after brief consolidation and reaches as high as 0.8699 so far. Intraday bias is back on the upside and the rise from0.8312 should target 0.8786 resistance next. As noted before, price actions 0.9304 are viewed as a medium term corrective pattern that is extending. Break of 0.8786 would now pave the way to retest 0.9304 high. On the downside, below 0.8602 minor support will turn intraday bias neutral again. But near term outlook will remain mildly bullish as long as 0.8529 resistance turned support holds.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. In case of deeper fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Rise from 0.6935 (2015 low) will resume at a later stage to 0.9799 (2008 high). However, sustained break of 0.8116 could bring deeper decline to next key support level at 0.7564 before the correction completes.