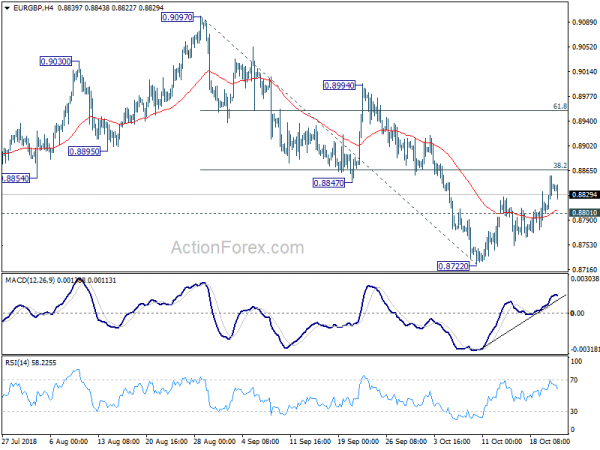

Daily Pivots: (S1) 0.8813; (P) 0.8836; (R1) 0.8865; More…

Intraday bias in EUR/GBP remains mildly on the upside with 0.8801 minor support intact. Whole fall from 0.9097 might be completed. Rebound from 0.8722 should target 38.2% retracement of 0.9097 to 0.8722 at 0.8865. Break will pave the way to 61.8% retracement at 0.8954 and above. On the downside, however, break of 0.8801 minor support will turn bias back to the downside for 0.8722 and possibly below.

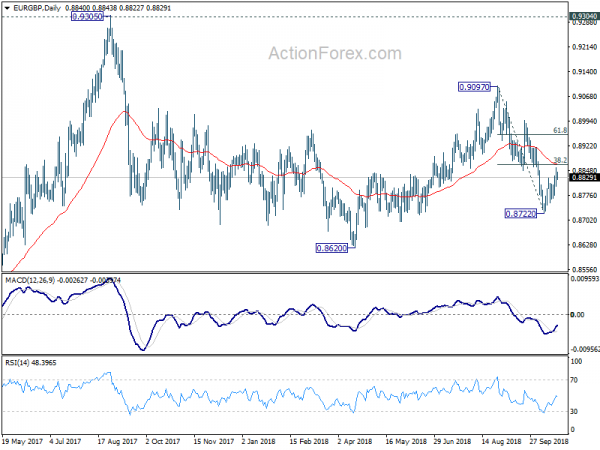

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Current development suggests that fall from 0.9303, as a down leg in the pattern, is still in progress. But in case of deeper fall, downside should be contained by 0.8116 cluster support, 50% retracement of 0.6935 (2015 low) to 0.9304 at 0.8120, to bring rebound. On the upside, break of 0.9097 will target 0.9304 resistance instead.