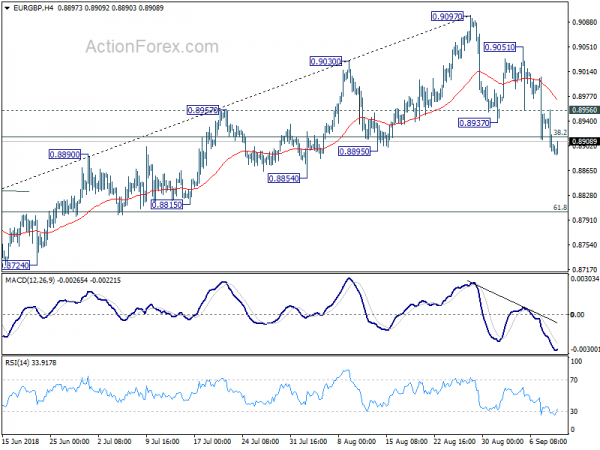

Daily Pivots: (S1) 0.8877; (P) 0.8918; (R1) 0.8942; More…

EUR/GBP drops to as low as 0.8889 so far and intraday bias stays on the downside. As noted before, corrective rise from 0.8620 could have completed at 0.9097 already. Break of 38.2% retracement of 0.8620 to 0.9097 at 0.8915 affirms our bearish view. Deeper decline should now be seen to 61.8% retracement at 0.8802 and below. On the upside, above 0.8956 minor resistance will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 0.9051 resistance holds.

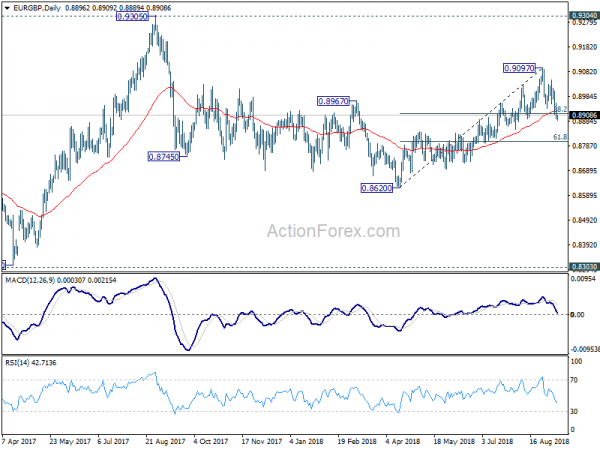

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). At this point, there is no clear sign of range break out yet. And more corrective trading would continue. On the upside, in case of another rise, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.