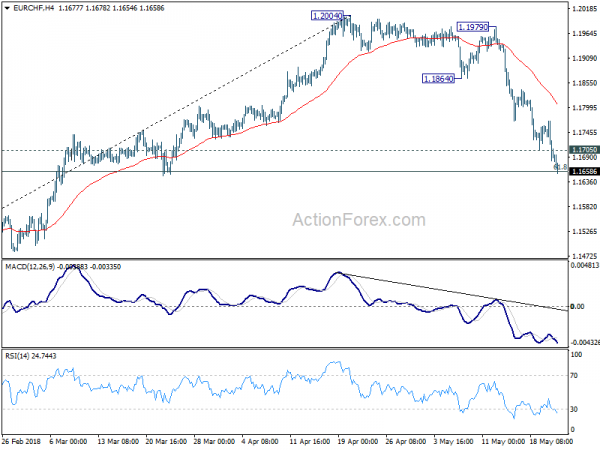

Daily Pivots: (S1) 1.1721; (P) 1.1743; (R1) 1.1781; More….

EUR/CHF’s decline resumed after brief consolidation and reaches as low as 1.1654 so far. Intraday bias is back on the downside. Sustained break of 61.8% retracement of 1.1445 to 1.2004 at 1.1659 will pave to way to key support level at 1.1445. We’d expect strong support from here to bring rebound, at least, on first attempt. On the upside, above 1.1705 minor resistance will turn bias neutral and bring consolidations first, before staying another fall.

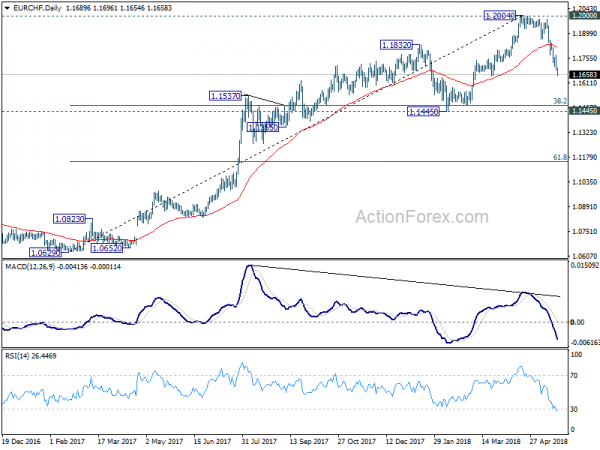

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 could be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Hence, for now, deeper fall could be seen back to 1.1445, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern.