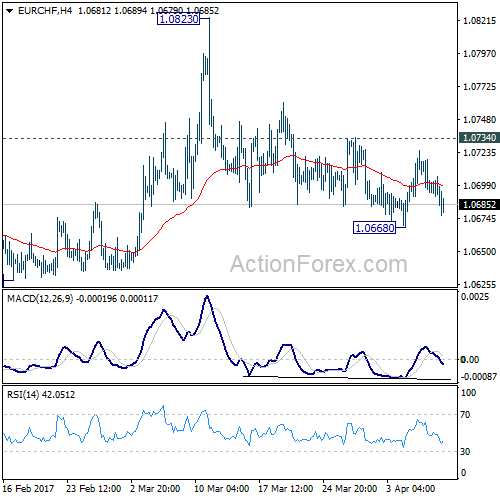

EUR/CHF recovered after dipping to 1.0668 last week. But upside was limited below 1.0734 minor resistance. Thus, the bearish outlook remains unchanged. That is, rebound from 1.0629 has completed at 1.0823. And the larger decline from 1.1198 is likely still in progress.

Initial bias in EUR/CHF remains neutral this week first. On the downside, below 1.0668 will target 1.0620/29 key support zone. Decisive break there will resume whole fall from 1.1198 and target next long term fibonacci level at 1.0485. Nonetheless, break of 1.0734 will suggest that pull back from 1.0823 is completed and turn bias back to the upside for this resistance.

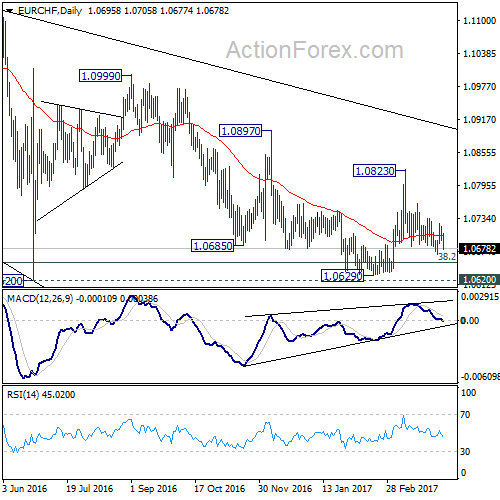

In the bigger picture, the decline from 1.1198 is seen as a corrective move. Current development suggests that it’s not completed yet. Sustained trading below 38.2% retracement of 0.9771 to 1.1198 at 1.0653 will target 50% retracement at 1.0485. In any case, break of 1.0823 resistance is needed to be the first indication of reversal. Otherwise, deeper fall is still expected even in case of recovery.