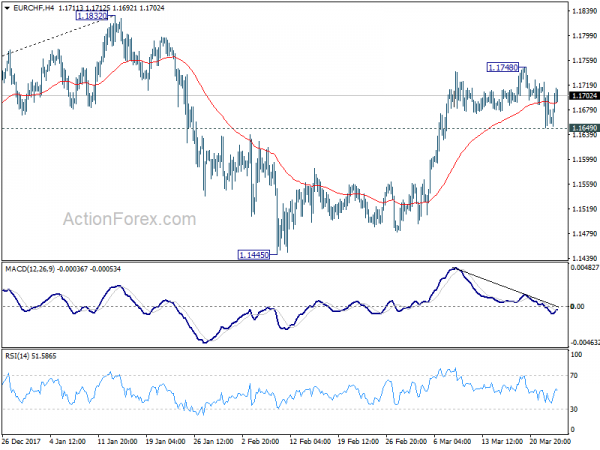

EUR/CHF dipped to 1.1649 last week but quickly recovered. Initial bias is turned neutral this week first. On the downside, below 1.1649 will affirm that case that corrective pattern from 1.1832 is extending with another falling leg. And, intraday bias will be turned to the downside for 55 day EMA (now at 1.1635). Sustained break will target 1.1445 support and possibly below. But we’d expect strong support from 1.1355 cluster support (38.2% retracement of 1.0629 to 1.1832 at 1.1372) to complete the correction and break up trend resumption. On the upside, above 1.1748 will bring retest of 1.1832 high instead.

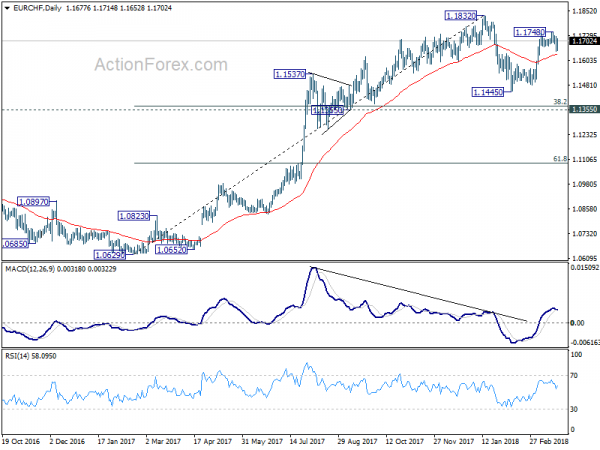

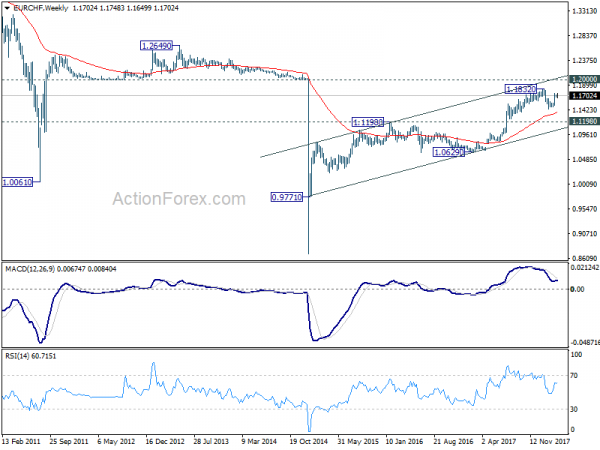

In the bigger picture, a medium term top should be in place at 1.1832 on bearish divergence condition in daily MACD. But there is no indication of long term reversal yet. As long as 1.1198 resistance turned support holds, we’d still expect another rise through prior SNB imposed floor at 1.2000.