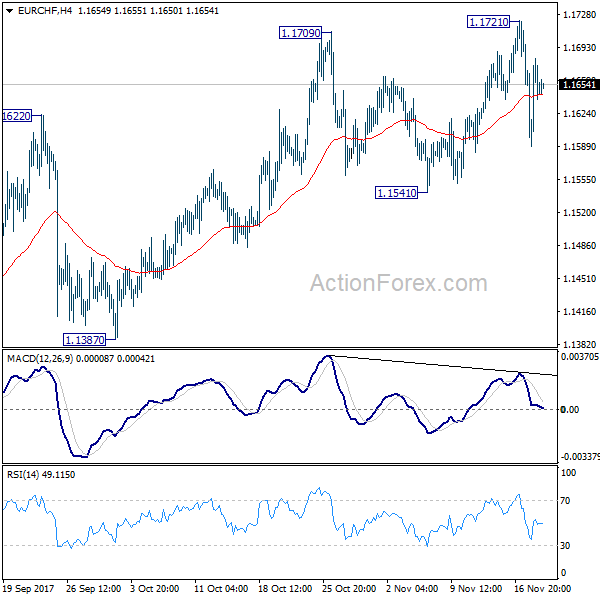

Daily Pivots: (S1) 1.1602; (P) 1.1642; (R1) 1.1694; More…

EUR/CHF’s fall from 1.1721 was held well above 1.1541 support and quickly recovered. Intraday bias is turned neutral first. On the downside, considering bearish divergence condition in 4 hour MACD and daily MACD, decisive break of 1.1541 will confirm topping and turn near term outlook bearish for 1.1355 key support. Nonetheless, on the upside, break of 1.1721 resistance will resume recent up trend towards 1.2 key level.

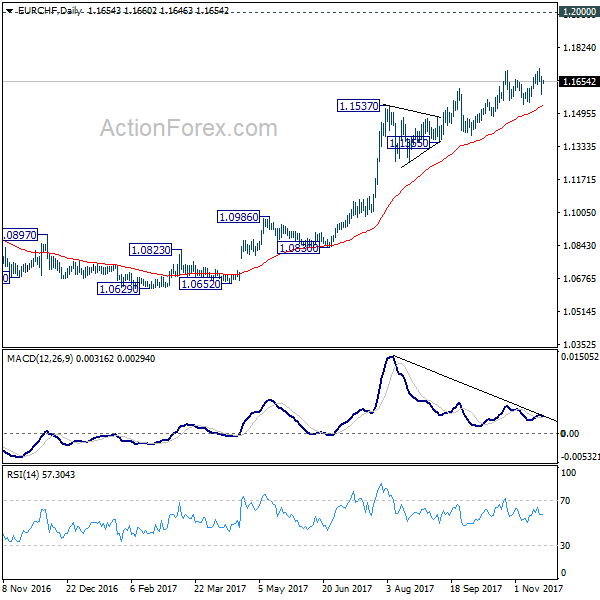

In the bigger picture, long term rise from SNB spike low back in 2015 is still in progress. EUR/CHF should now be heading back to prior SNB imposed floor at 1.2000. For now, this will be the favored case as long as 1.1355 support holds. However, break of 1.1355 will indicate medium term topping. In that case, EUR/CHF should head back to 55 week EMA (now at 1.1158) and possibly below.