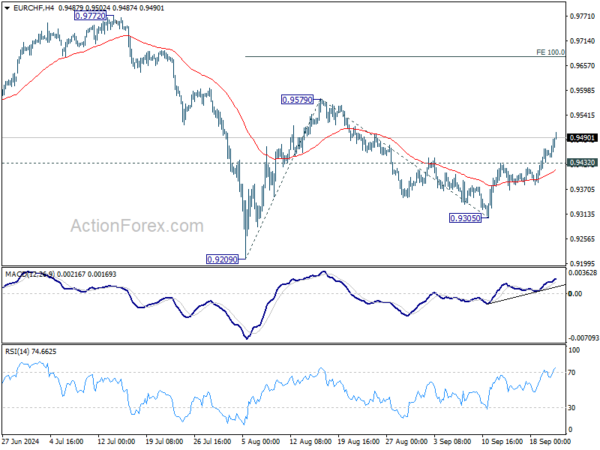

EUR/CHF’s strong rebound last week suggest that pull back from 0.9579 has completed at 0.9305. Rise from there is now seen as the third leg of the pattern from 0.9209. Initial bias stays on the upside for 0.9579 resistance first. Firm break there will target 100% projection of 0.9209 to 0.9579 from 0.9305 at 0.9675. On the downside, below 0.9432 minor support will turn intraday bias neutral first.

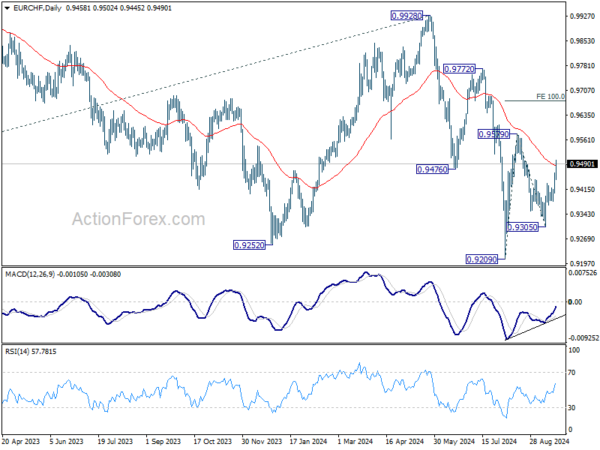

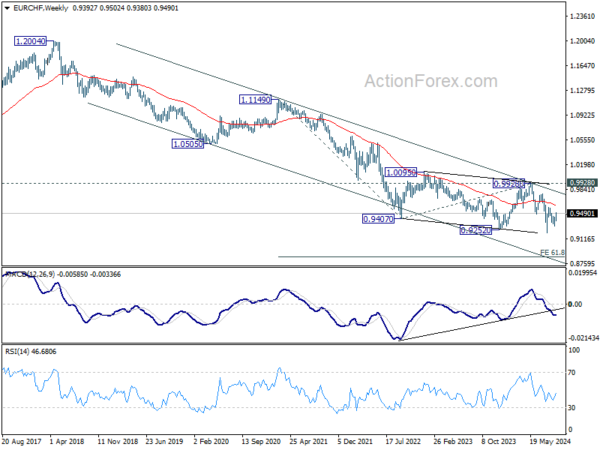

In the bigger picture, medium term corrective pattern from 0.9407 (2022 low) might have completed with three waves to 0.9928. Decisive break of 0.9252 (2023 low) will confirm long term down trend resumption. Next target will be 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. For now, outlook will stay bearish as long as 0.9928 resistance holds, even in case of strong rebound.

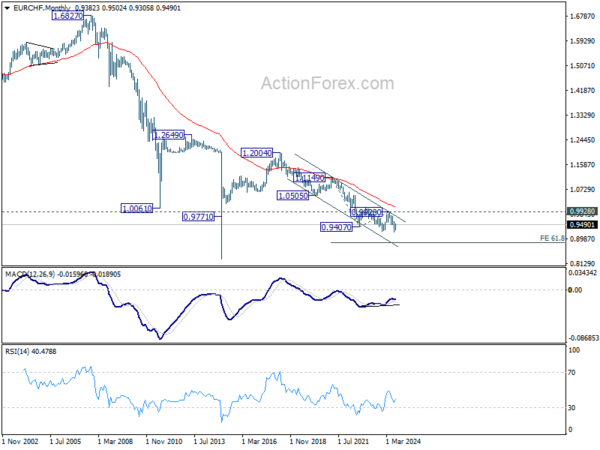

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 0.9928 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.