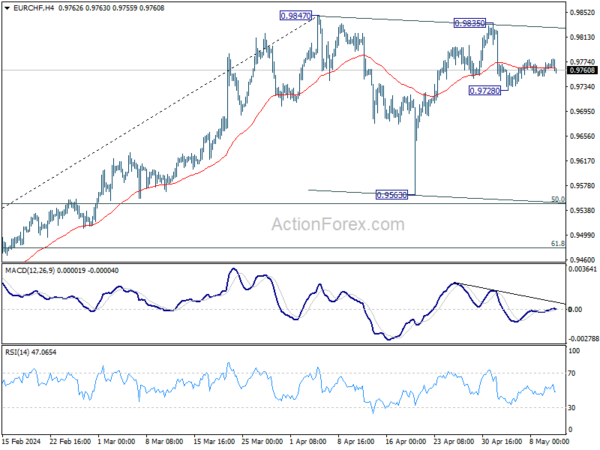

EUR/CHF turned into sideway consolidations last week but overall outlook is unchanged. Initial bias remains neutral this week first. Fall from 0.9835 is seen as the third leg of the corrective pattern from 0.9847. Risk will stay on the downside as long as 0.9835 resistance holds. Below 0.9728 will target 0.9563. But strong support is expected from 50% retracement of 0.9252 to 0.9847 at 0.9550 to complete the pattern.

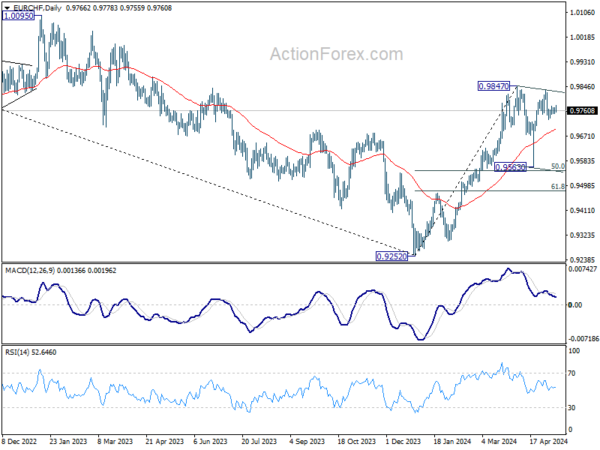

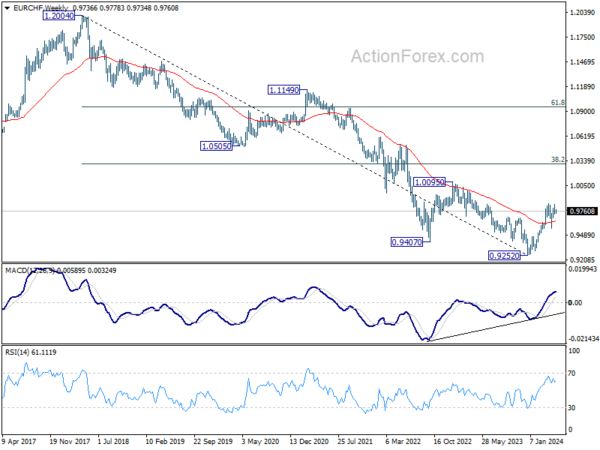

In the bigger picture, as long as 0.9563 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Break of 0.9847 resistance will target 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even as a correction to the down trend from 1.2004.

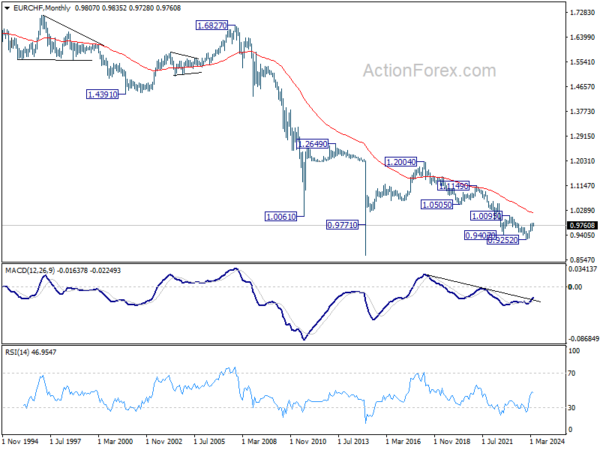

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.