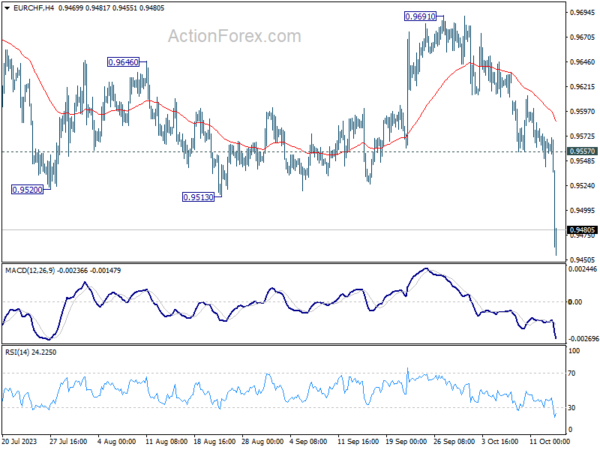

EUR/CHF’s decisive break of 0.9513 support last week confirms resumption of whole down trend from 1.0095. Initial bias remains on the downside this week for retesting 0.9407 medium term bottom. On the upside, break of 0.9557 resistance is needed to be the first sign of short term bottoming. Otherwise, risk will stay on the downside in case of recovery.

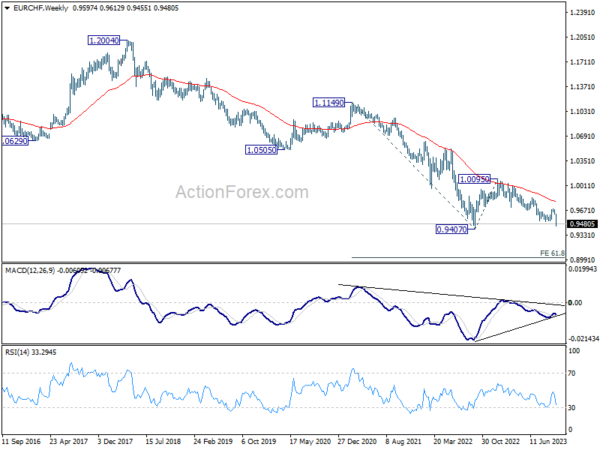

In the bigger picture, medium term outlook remains bearish with the cross capped well below falling 55 W EMA (now at 0.9782). Firm break of 0.9407 (2022 low) will confirm resumption of larger down trend from 1.2004 (2018 high). Next target will be 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018. On the upside, break of 0.9691 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish.

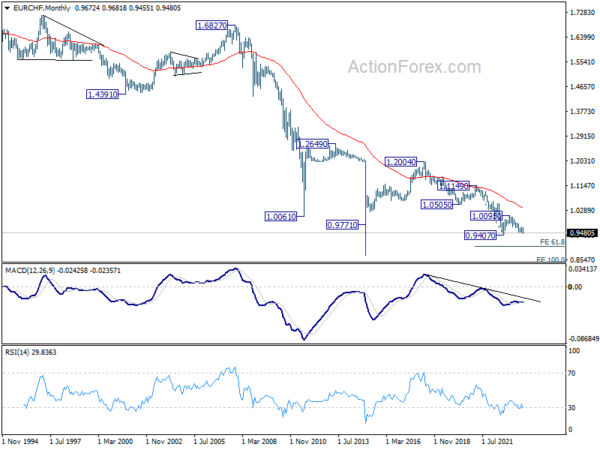

In the long term picture, outlook remains bearish as it’s staying well below 55 M EMA (now at 1.0362). Break of 1.0095 resistance is needed to be the first sign of bottoming, or the multi-decade down trend is expected to continue.