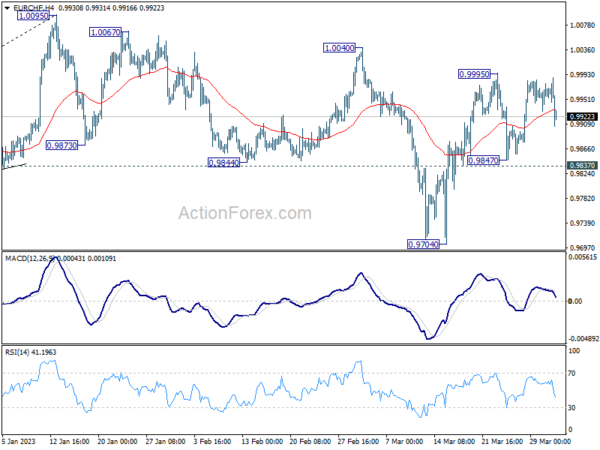

EUR/CHF stayed in range below 0.9995 last week but with 0.9837 minor support intact, near term outlook stays cautiously bullish. Initial bias remains neutral this week first. Correction from 1.0095 could have completed at 0.9704 already. Break of 0.9995 will affirm this bullish case and target a retest on 1.0095 high. However, break of 0.9837 will dampen this bullish view and turn bias back to the downside for 0.9704 support instead.

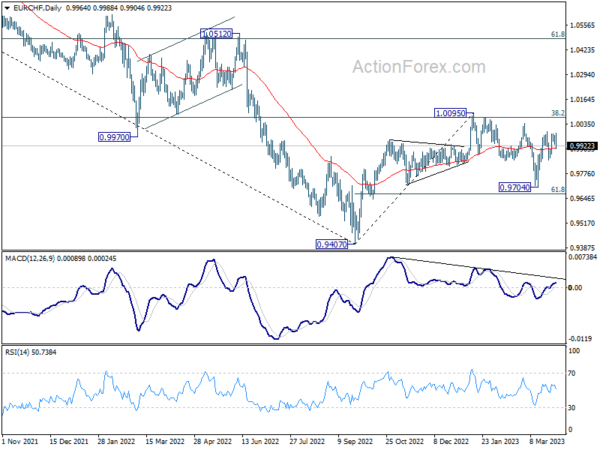

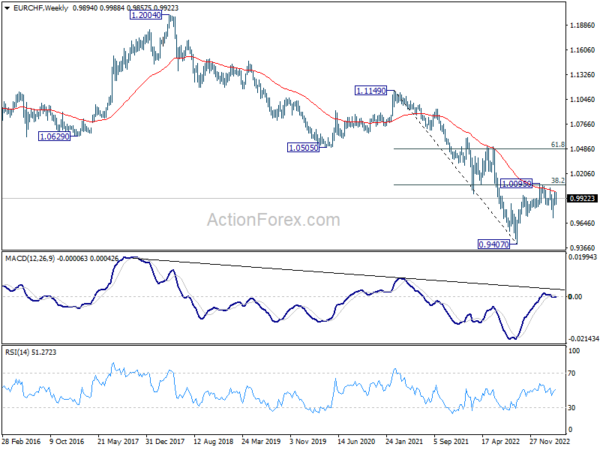

In the bigger picture, prior rejection by 55 week EMA (now at 1.1002) and 38.2% retracement of 1.1149 to 0.9407 at 1.0072 suggests that medium term outlook is staying bearish. That is, down trend from 1.2004 is not completed yet and is in favor to resume through 0.9407 at a later stage. However, decisive break of 1.0095 resistance will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484).

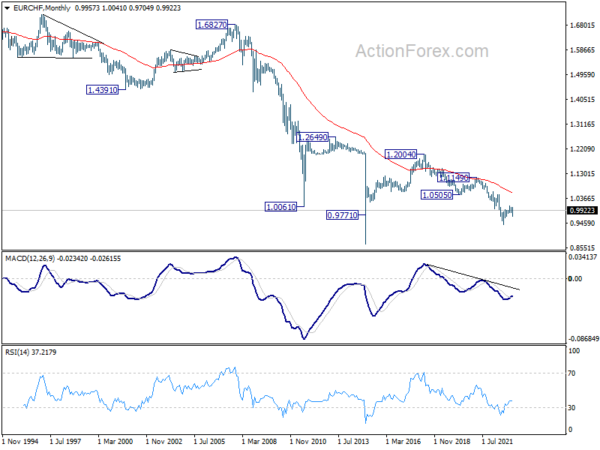

In the long term picture, it’s still way too early too call for bullish trend reversal with upside capped well below 55 month EMA and 1.0505 support turned resistance (2020 low). The multi-decade down trend could still continue.