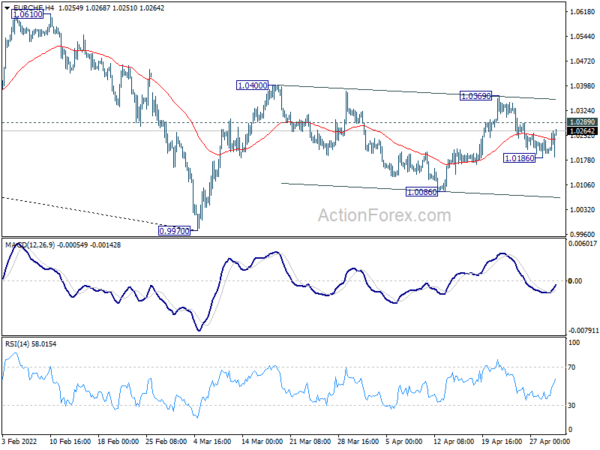

EUR/CHF extended the corrective pattern from 1.0400 with another fall last week, and dipped to 1.0186. As a temporary low was formed there, initial bias is neutral this week first. Another decline cannot be ruled out with 1.0289 minor resistance intact. Below 1.0186 will target 1.0086 support. On the upside, above 1.0289 will target 1.0369/0400 resistance zone. Firm break there will resume the rebound from 0.9970 to 1.0610 structural resistance.

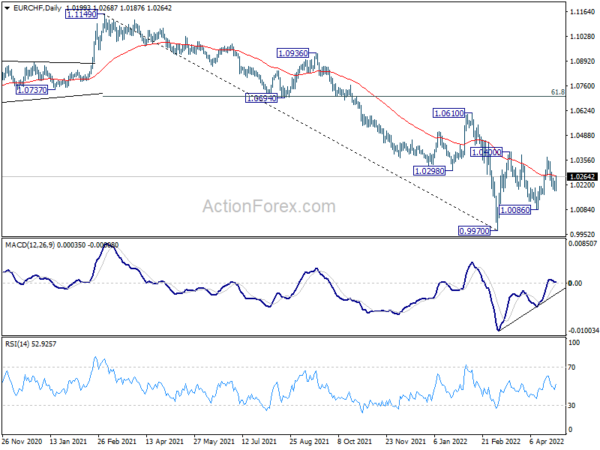

In the bigger picture, as long as 1.0505 support turned resistance (2020 low) holds, long term down trend from 1.2004 (2018 high) is expected to continue. Next target is 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650. However, firm break of 1.0505 will suggest medium term bottoming, and bring stronger rebound towards 1.1149 structural resistance.

In the long term picture, capped below 55 month EMA, EUR/CHF is seen as extending the multi-decade down trend. There is no prospect of a bullish reversal until some sustained trading above the 55 month EMA (now at 1.0891).