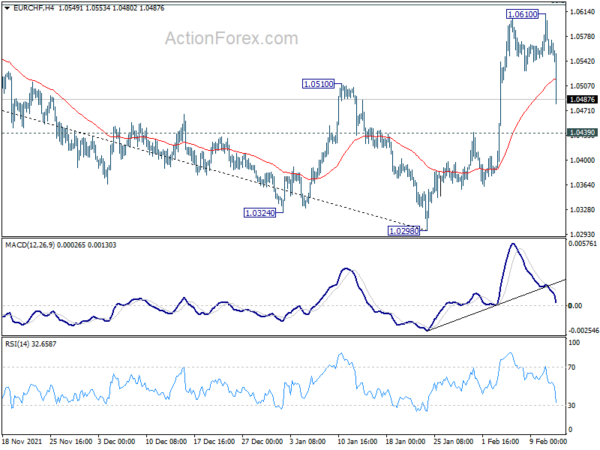

EUR/CHF edged higher to 1.0610 last week but the fall from there accelerated to close at 1.0487. Initial bias is neutral this week first. Break of 1.0439 support will argue that rebound from 1.0298 has completed, ahead of 38.2% retracement of 1.1149 to 1.0298 at 1.0623. Deeper fall will then be seen back to retest 1.0298 lower. On the upside, sustained break of 1.0623 will raise the chance of trend reversal and target 61.8% retracement at 1.0824 next.

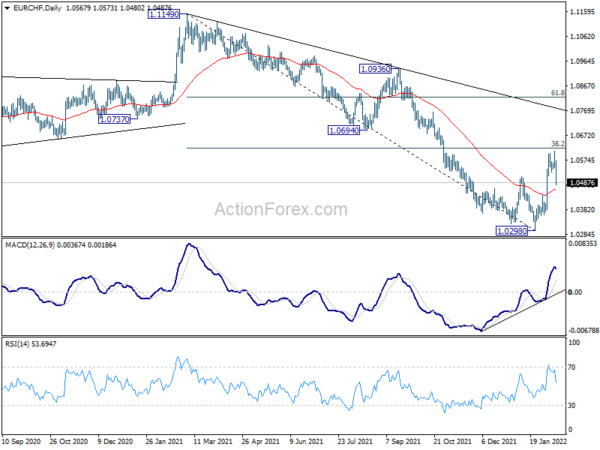

In the bigger picture, a medium term bottom was formed at 1.0298 on bullish convergence condition in daily MACD. Rebound from there is still tentatively viewed part of a corrective pattern. That is, larger down trend from 1.2004 (2018) could still extend through 1.0298 to 61.8% projection of 1.2004 to 1.0505 to 1.1149 at 1.0223. However, sustained trading above 55 week EMA (now at 1.0673) will argue that the down trend is over, and bring stronger rise back to 1.1149 next.

In the long term picture, prior rejection by 55 month EMA (now at 1.0967) maintains long term bearishness. Down trend from 1.2004 could still extend lower as long as 1.1149 resistance holds.