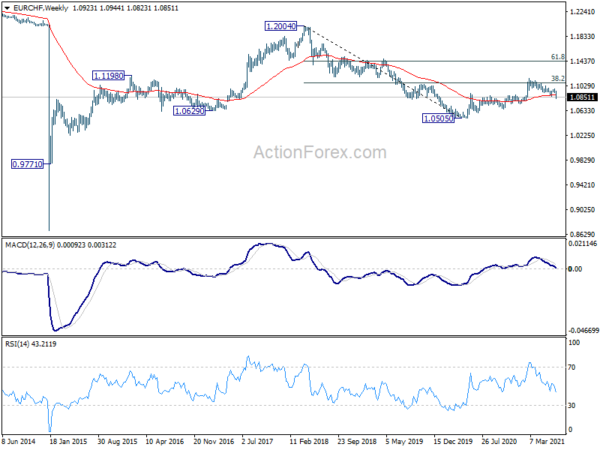

EUR/CHF’s decline from 1.1149 resumed last week and hit as low as 1.0823. A temporary low was formed there with subsequent recovery. Initial bias is turned neutral this week first. Some consolidations could be seen. But overall outlook will stay bearish as long as 1.0985 resistance holds. Break of 1.0823 will resume the decline to 1.0737 cluster support next.

In the bigger picture, current development argues that rebound from 1.0505 (2020 low) might be completed with three waves up to 1.1149 already. Sustained trading below 55 week EMA (now at 1.0885) will affirm this bearish case. Further break of 1.0737 cluster support (61.8% retracement of 1.0505 to 1.1149 at 1.0751) will bring retest of 1.0505 low.

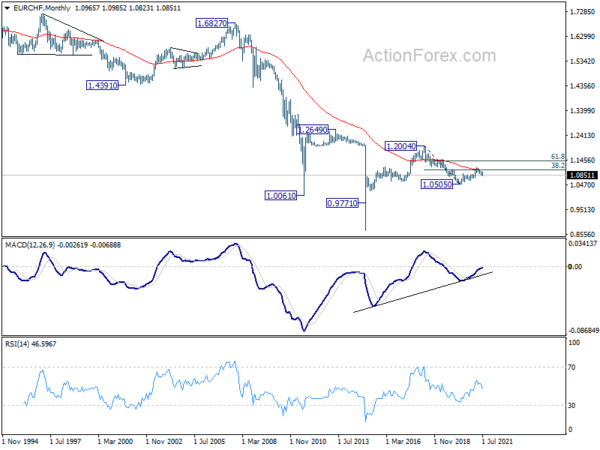

In the long term picture, price actions from 1.0505 are currently seen as a correction to down trend from 1.2004 (2018 high). only. The failure to sustain above 38.2% retracement of 1.2004 to 1.0505 at 1.1078 retains long term bearishness. This is also affirmed by rejection by 55 month EMA. Another fall through 1.0505 is mildly in favor for now.