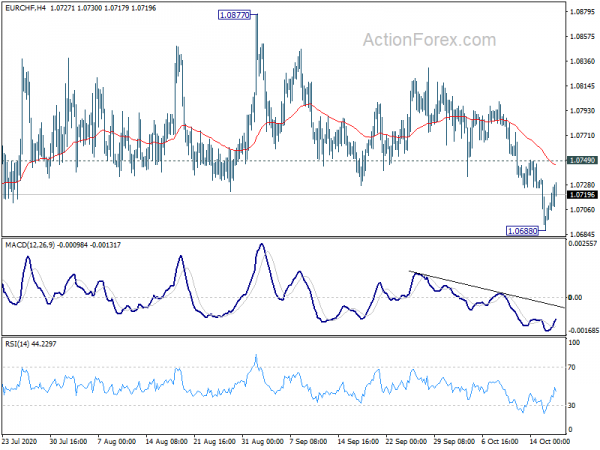

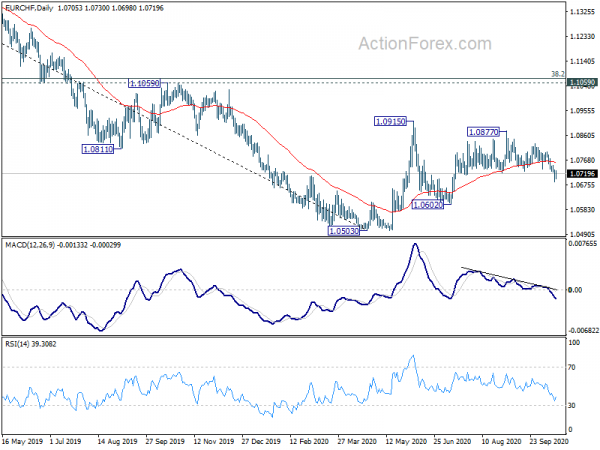

EUR/CHF finally broke out of range last week and dipped to as low as 1.0688. But as a temporary low was formed with subsequent recovery, initial bias is neutral this week first. Current development suggests that consolidation from pattern from 1.0915 has started the third leg. Break of 1.0688 will target 1.0602 support and possibly below. However, on the upside, break of 1.0749 minor resistance will mix up the near term outlook again.

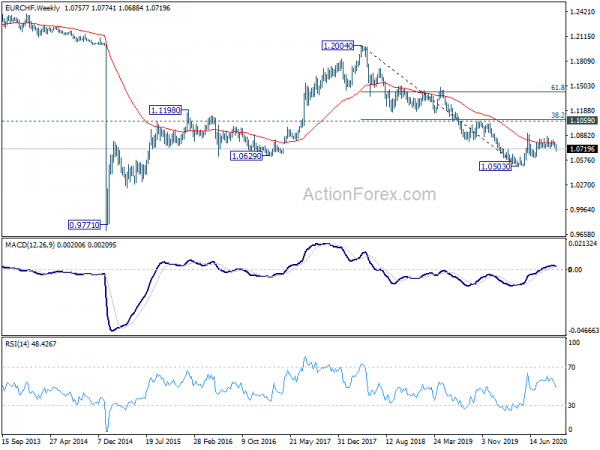

In the bigger picture, price actions from 1.0503 are still seen as a consolidation pattern. With 1.1059 cluster resistance (38.2% retracement of 1.2004 to 1.0503 at 1.1076) intact, the down trend from 1.2004 (2018 high) would still extend through 1.0503 low at a later stage. However, sustained break of 1.1059/76 will argue that rise from 1.0503 is starting a new up trend and would target 61.8% retracement at 1.1431 and above.