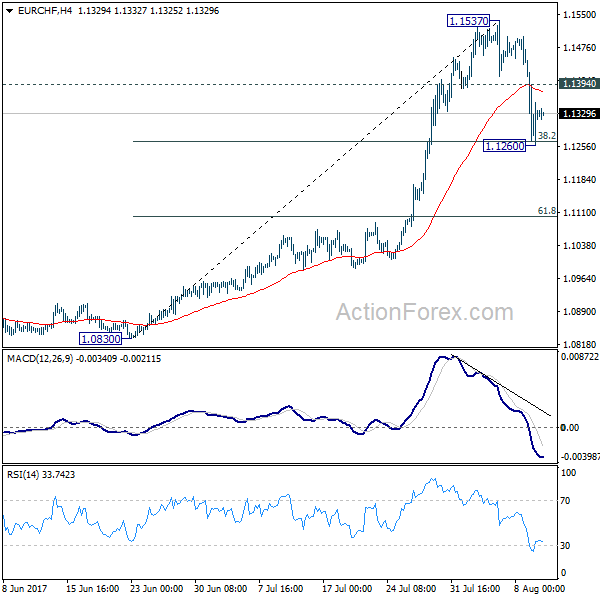

Daily Pivots: (S1) 1.1243; (P) 1.1345; (R1) 1.1429; More…

EUR/CHF’s correction extended to as low as 1.1260 and draws support from 38.2% retracement of 1.0830 to 1.1537 at 1.1267 to recover. Intraday bias is turned neutral first. Break of 1.1394 will suggests that such pull back is completed and turn bias back to the upside for retesting 1.1537 first. However, firm break of 1.1267 will extend the fall and target 61.8% retracement at 1.1100.

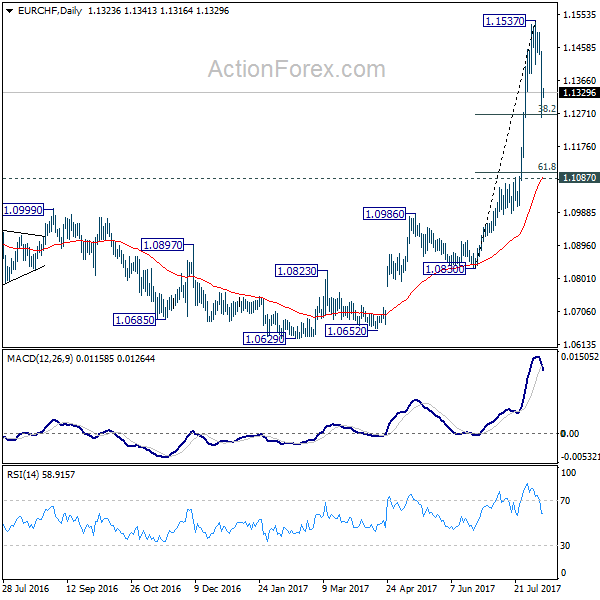

In the bigger picture, firm break of 1.1198 key resistance confirms resumption of the long term rise from SNB spike low back in 2015. In this case, EUR/CHF would eventually head back to prior SNB imposed floor at 1.2000. For now, this will be the favored case as long as 1.1087 resistance turned support holds.