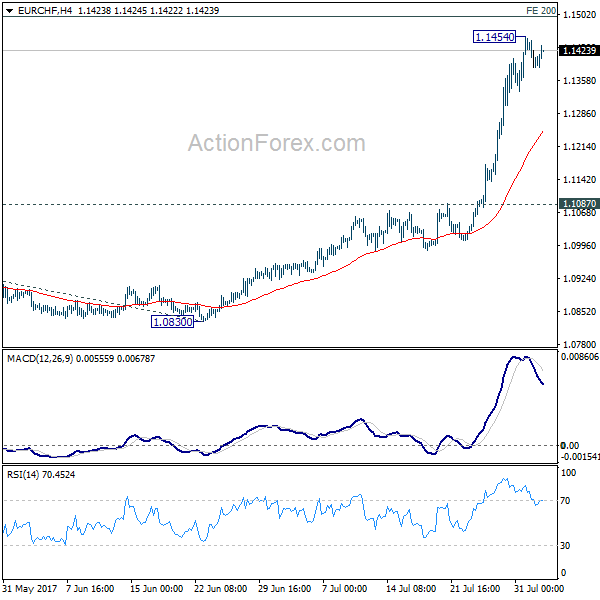

Daily Pivots: (S1) 1.1372; (P) 1.1410; (R1) 1.1435; More…

A temporary top is likely in place at 1.1454 in EUR/CHF with 4 hour MACD staying well below signal line. Intraday bias is turned neutral first and deeper retreat could be seen. But downside should be contained by 4 hour 55 EMA (now at 1.1248) and bring rise resumption. Above 1.1454 will extend recent rise from 1.0629 to 200% projection of 1.0652 to 1.0986 from 1.0830 at 1.1498. Break will target 261.8% projection at 1.1704 next. Nonetheless, sustained break of 1.1248 will indicate short term topping and bring lengthier consolidation first.

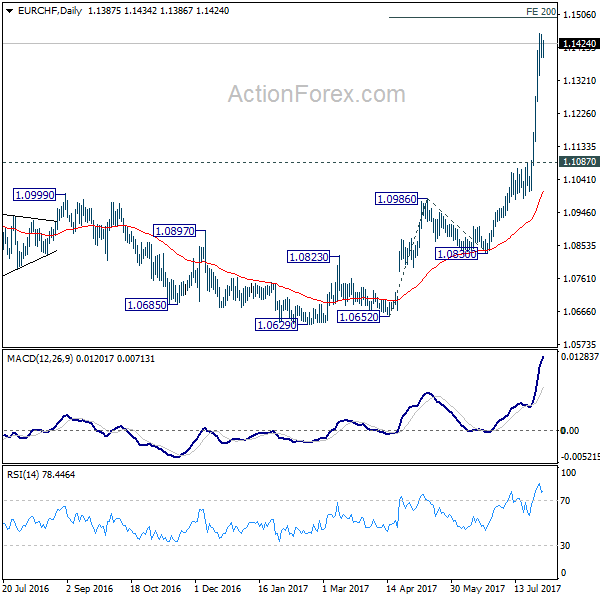

In the bigger picture, sustained break of 1.1198 key resistance confirms resumption of the long term rise from SNB spike low back in 2015. In this case, EUR/CHF would eventually head back to prior SNB imposed floor at 1.2000. For now, this will be the favored case as long as 1.1087 resistance turned support holds.