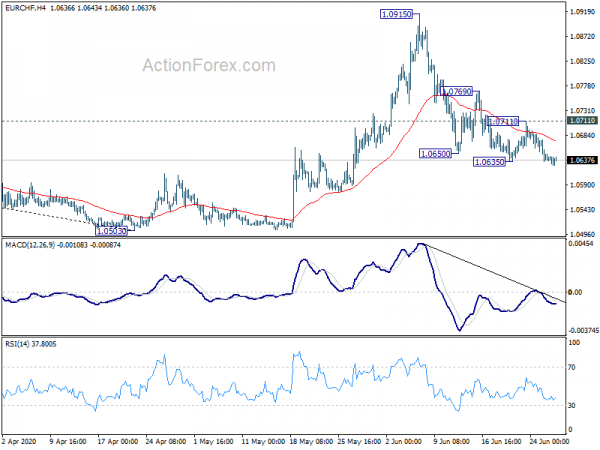

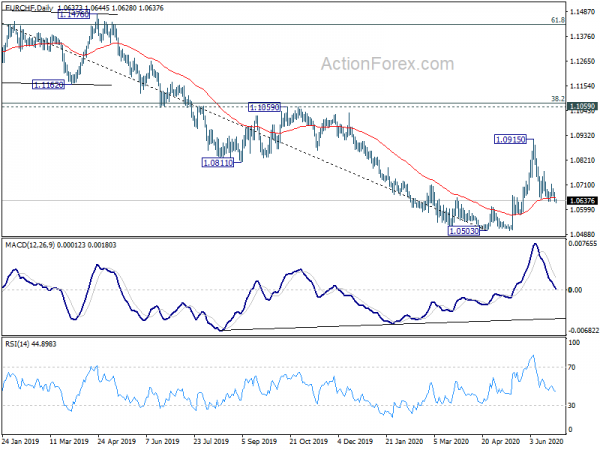

EUR/CHF recovered in the middle of last week but the decline from 1.0915 quickly resumed. Initial bias stays on the downside this week. With 55 day EMA taken out again, deeper fall should be seen to retest 1.0503 low. On the upside, break of 1.0711 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain cautiously bearish in case of recovery.

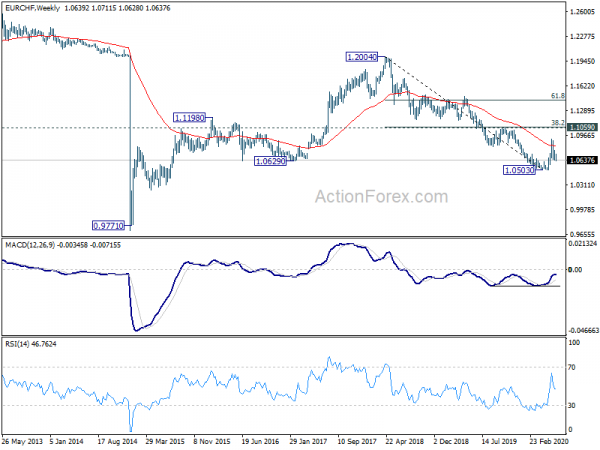

In the bigger picture, as long as 1.1059 cluster resistance (38.2% retracement of 1.2004 to 1.0503 at 1.1076) holds, price actions from 1.0503 are seen as a consolidation pattern. That is, down trend from 1.2004 (2018 high) would still extend through 1.0503 low at a later stage. However, sustained break of 1.1049/76 will argue that rise from 1.0503 is starting a new up trend and would target 61.8% retracement at 1.1431 and above.