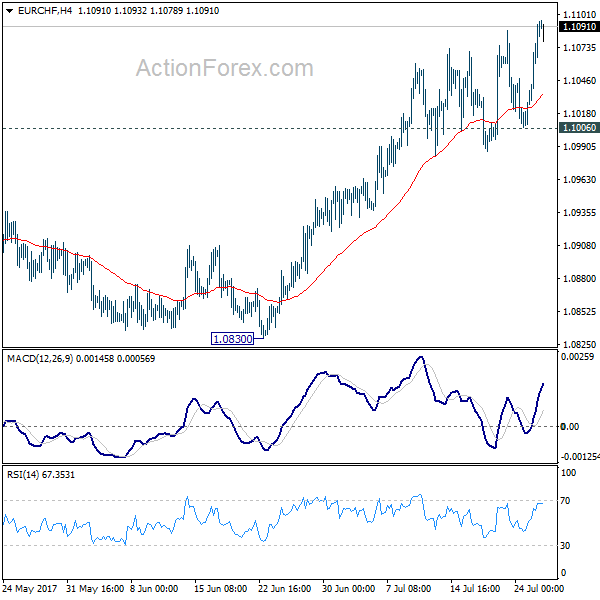

Daily Pivots: (S1) 1.1035; (P) 1.1064; (R1) 1.1119; More…

EUR/CHF’s rally resumed by taking out 1.1087 and intraday bias is back on the upside. Current rise is expected to target key resistance at 1.1127/98. On the downside, break of 1.1006 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

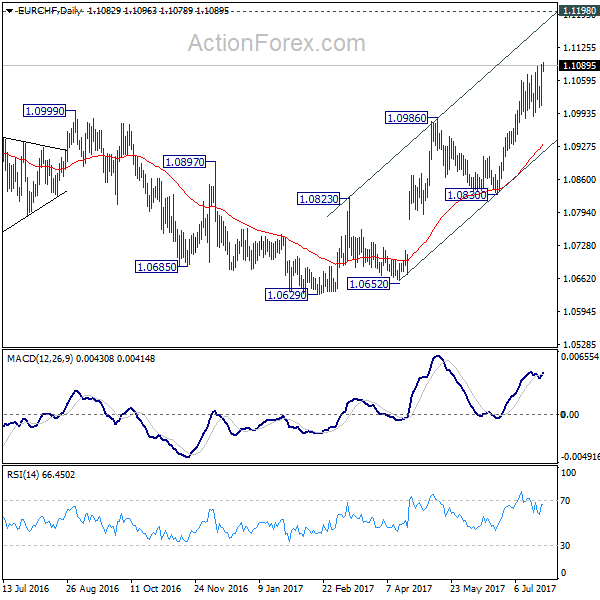

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.1198 will resume the long term rise from SNB spike low back in 2015. In such case, EUR/CHF could eventually head back to prior SNB imposed floor at 1.2000. We’ll favor this bullish case as long as 1.0830 support holds. However, rejection from 1.1198 will extend the multi-year range trading with another fall.