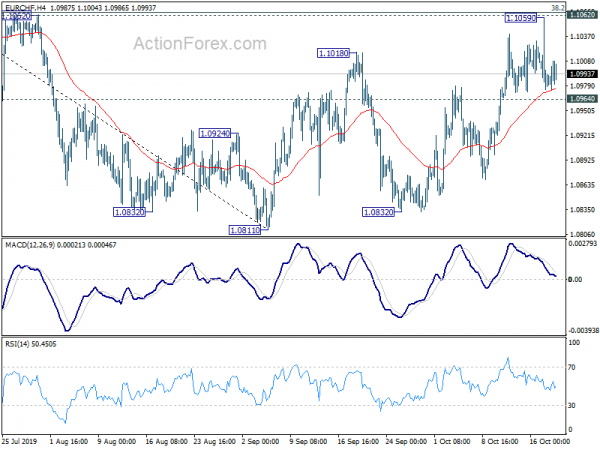

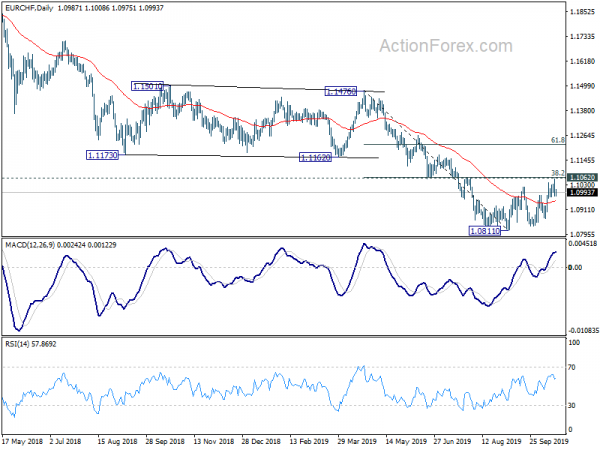

EUR/CHF edged higher to 1.1059 last week but failed to break through 1.1062 cluster resistance (38.2% retracement of 1.1476 to 1.0811 at 1.1065). Initial bias is neutral this week for some sideway trading first. Outlook is unchanged that price actions from 1.0811 are viewed as a consolidation pattern. That is, larger down trend is expected to resume sooner or later. On the downside, break of 1.0964 minor support will turn bias to the downside for retesting 1.0811 low. However, sustained break of 1.1062/5 will carry larger bullish implication and bring stronger rise.

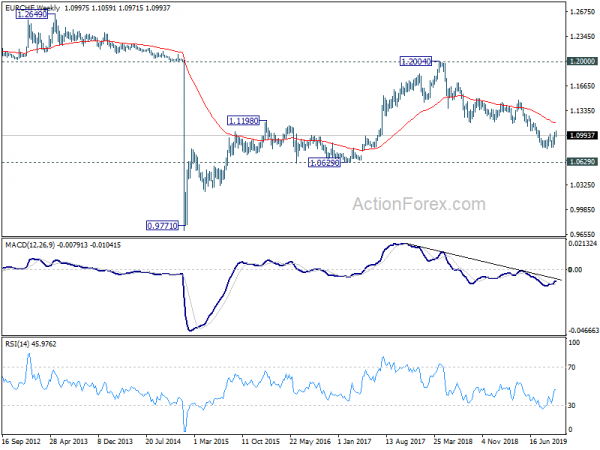

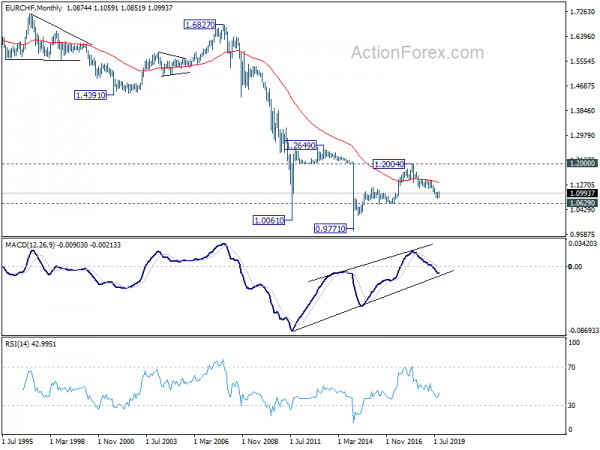

In the bigger picture, down trend from 1.2004 is (2018 high) is still in progress. More importantly, it’s likely a long term down trend itself, rather than a correction. Further fall should be seen to 1.0629 support and possibly below. On the upside, break of 1.1162 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.