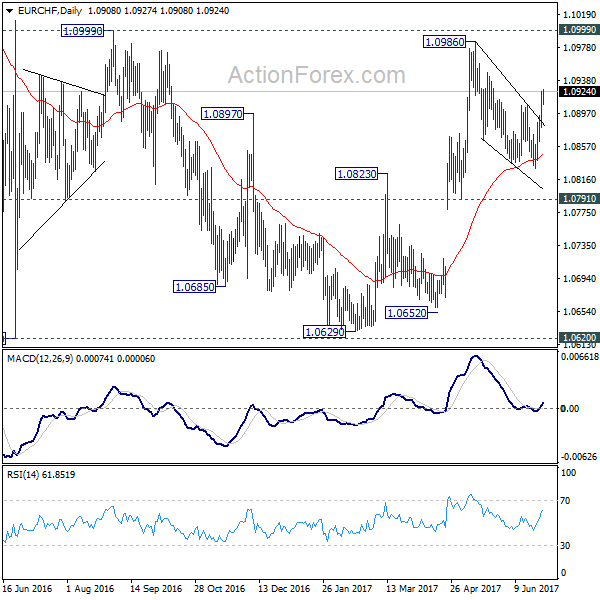

Daily Pivots: (S1) 1.0890; (P) 1.0908; (R1) 1.0934; More…

EUR/CHF’s rebound from 1.0830 extended. The break of 1.0908 resistance suggests that the corrective pull back from 1.0986 has finally completed at 1.0830. Intraday bias is back on the upside for retesting 1.0986/0999 resistance zone first. On the downside, below 1.0880 minor support will dampen the bullish view again and turn bias neutral. In case of another fall, we’d still expect downside to be contained by 1.0791/0872 support zone to bring rebound.

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0791 support holds.