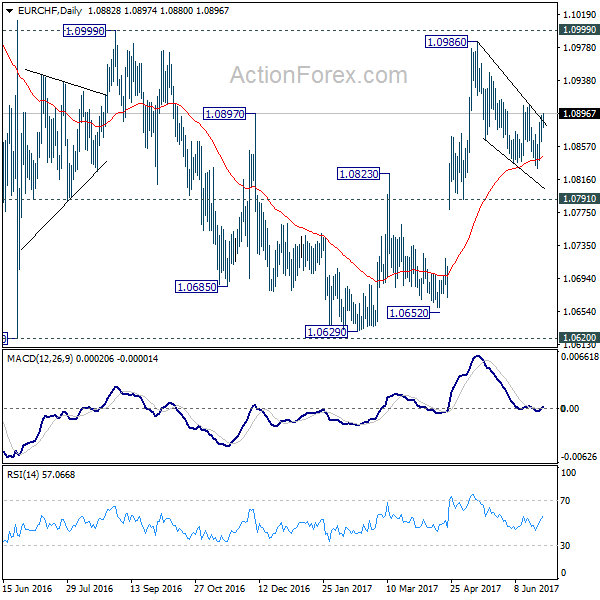

Daily Pivots: (S1) 1.0868; (P) 1.0882; (R1) 1.0901; More…

EUR/CHF’s recovery from 1.0830 continues today but it’s staying below 1.0908 resistance. Intraday bias remains neutral for the moment. On the upside, break of 1.0908 will indicate that the correction from 1.0986 has completed. In such case, intraday bias is turned back to the upside for retesting 1.0986/0999 resistance zone. In case of another fall, downside should be contained by 1.0791/0872 support zone to bring rebound.

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0791 support holds.