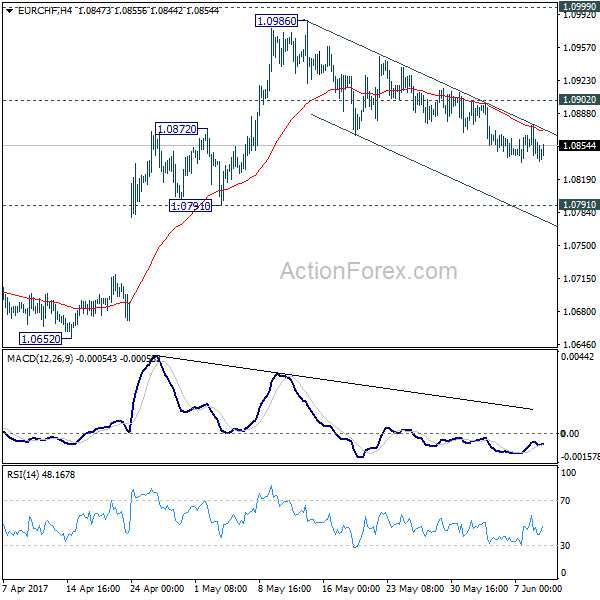

Daily Pivots: (S1) 1.0835; (P) 1.0855; (R1) 1.0866; More…

The corrective fall from 1.0986 short term top is still in progress. Outlook in EUR/CHF is unchanged. Downside is expected to be contained by 1.0791/0872 support zone, probably around 55 day EMA (now at 1.0830 and bring rebound. Above 1.0902 minor resistance will turn bias back to the upside for 1.0986/0999.

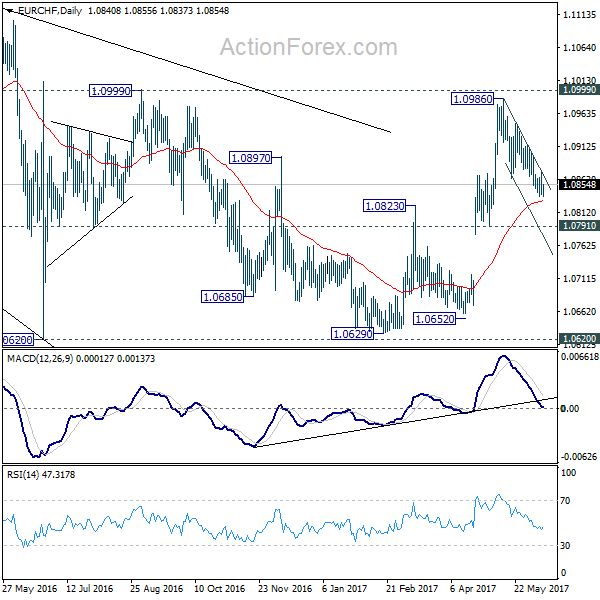

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.0999 resistance will target a test on 1.1198 high. For now, this will be the preferred case as long as 1.0791 support holds.