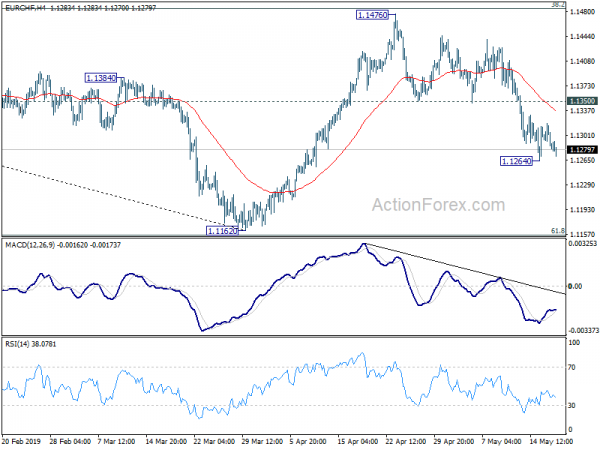

Daily Pivots: (S1) 1.1271; (P) 1.1295; (R1) 1.1309; More…

Intraday bias in EUR/CHF remains neutral for the moment. More consolidation could be seen above 1.1264 temporary low first. Still, further decline is expected as long as 1.1350 support tuned resistance holds. On the downside below 1.1264 will extend the corrective fall from 1.1476 towards 1.1162 low. We’d expect strong support above there to bring rebound. On the upside, break of 1.1350 will suggest that the pull back has completed. Intraday bias will be turned back to the upside for 38.2% retracement of 1.2004 to 1.1162 at 1.1484 again.

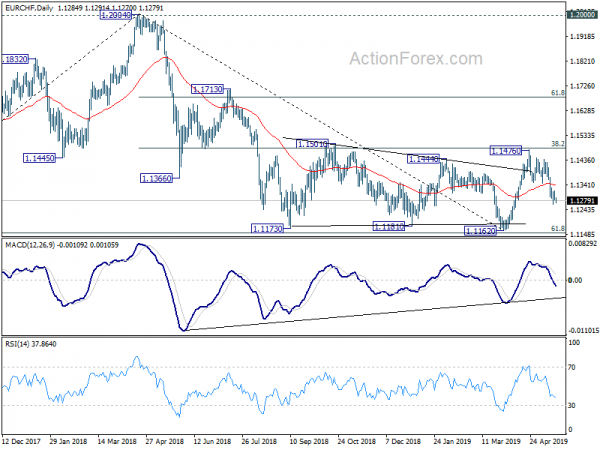

In the bigger picture, at this point, we’re slightly favoring the case that corrective fall from 1.2004 has completed after being supported by 61.8% retracement of 1.0629 to 1.2004 at 1.1154. Decisive break of 1.1501 resistance should confirm and target 1.1713 resistance next. On the downside, firm break of 1.1154 is needed to confirm down trend resumption. Otherwise, medium term outlook will be neutral at worst.