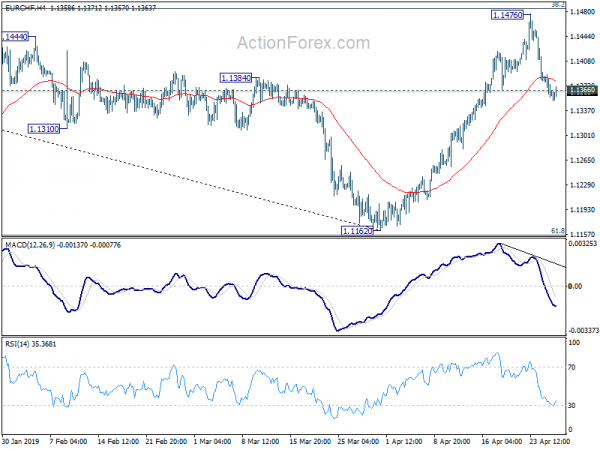

Daily Pivots: (S1) 1.1347; (P) 1.1368; (R1) 1.1381; More…

EUR/CHF’s break of 1.1365 minor support suggests short term topping at 1.1476, after being rejected by 38.2% retracement of 1.2004 to 1.1162 at 1.1484. Intraday bias is turned back to the downside for 55 day EMA (now at 1.1324). Sustained break will bring deeper decline to retest 1.1162 low. On the upside, break of 1.1484 fibonacci resistance will confirm completion of corrective fall from 1.2004. Further rally should then be seen to 61.8% retracement at 1.1682 and above.

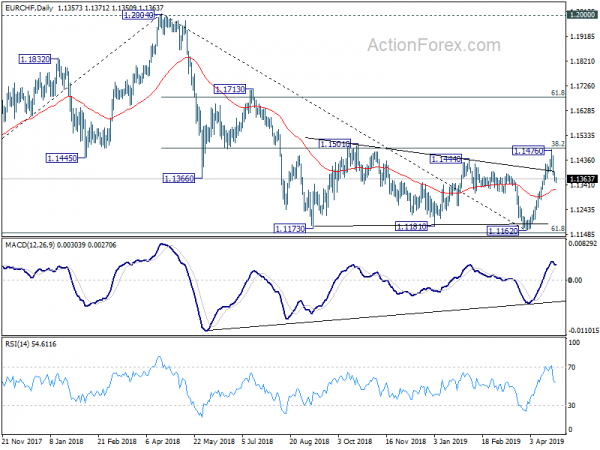

In the bigger picture, focus is back on 1.1444 resistance with current rebound. Decisive break there will indicate completion of the decline from 1.2004, with support from 61.8% retracement of 1.0629 to 1.2004 at 1.1154. In this case, further rise should be seen to 1.1713 resistance next. On the downside, firm break of 61.8% retracement of 1.0629 to 1.2004 at 1.1154 is now needed to confirm down trend resumption. Otherwise, medium term outlook will be neutral at worst.