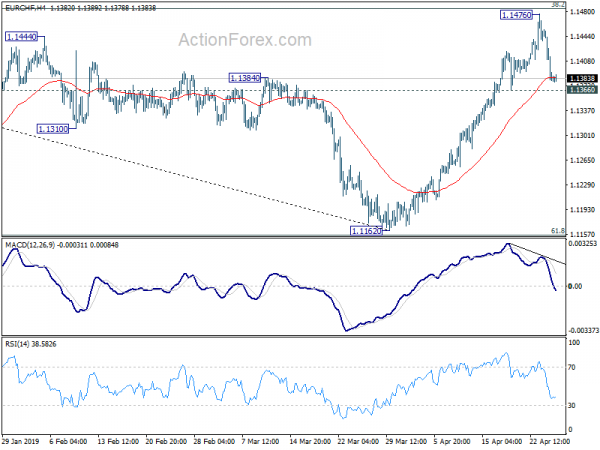

Daily Pivots: (S1) 1.1355; (P) 1.1407; (R1) 1.1434; More…

EUR/CHF’s pull back from 1.1476 extends lower but stays above 1.1366 minor support. Intraday bias remains neutral first. Near term outlook stays bullish as long as 1.1366 minor support holds and further rally is expected. On the upside, decisive break of 38.2% retracement of 1.2004 to 1.1162 at 1.1484 should confirm completion of corrective fall from 1.2004. Further rally should then be seen to 61.8% retracement at 1.1682 and above. Nevertheless, break of 1.1366 would indicate rejection from 1.1484 fibonacci level and turn bias to the downside.

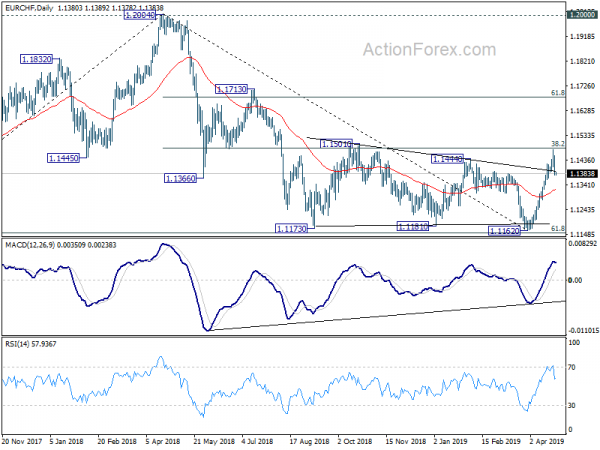

In the bigger picture, focus is back on 1.1444 resistance with current rebound. Decisive break there will indicate completion of the decline from 1.2004, with support from 61.8% retracement of 1.0629 to 1.2004 at 1.1154. In this case, further rise should be seen to 1.1713 resistance next. On the downside, firm break of 61.8% retracement of 1.0629 to 1.2004 at 1.1154 is now needed to confirm down trend resumption. Otherwise, medium term outlook will be neutral at worst.